Are San Antonio Home Prices Stabilizing? What Buyers and Sellers Should Expect Next

Are San Antonio Home Prices Stabilizing? What Buyers and Sellers Should Expect Next

After years of rapid swings, San Antonio home prices are showing signs of stabilization rather than growth or decline. Higher inventory, longer days on market, and strong competition from builders offering incentives are keeping prices from rising while preventing a sharp drop. For San Antonio buyers across Bexar County, Boerne, Schertz, and surrounding communities, this means more choice and leverage. For sellers throughout Greater San Antonio, it means pricing accuracy and strategy matter more than timing. These conditions reflect a market recalibrating to more normal rhythms.

Direct Answer

Yes, San Antonio home prices appear to be stabilizing. Elevated inventory, slower sales, and builder incentives are putting a ceiling on appreciation, while steady demand is helping prevent a market collapse.

Key Points at a Glance

- Home prices in San Antonio are largely flat, not rising

- Inventory is higher, giving buyers more choices

- Sales are slower, and days on market are longer

- Builder incentives are influencing buyer expectations

- Prices are holding where homes are priced correctly

- Strategy now matters more than speed

Are San Antonio Home Prices Stabilizing?

After years of whiplash-inducing swings, the San Antonio real estate market appears to be catching its breath. Buyers who felt locked out during the pandemic frenzy are noticing more options. Sellers who grew accustomed to multiple offers over a weekend are adjusting to a different rhythm. The market today reflects a mix of slowing sales and settling prices, which is why the idea of stabilization fits better than either boom or bust.

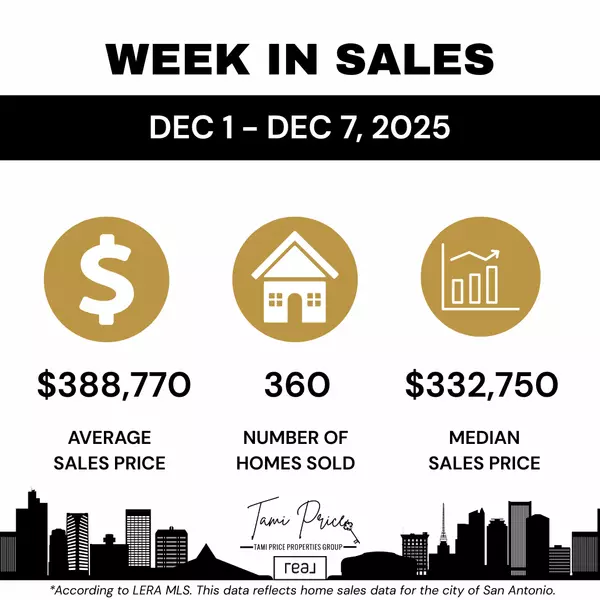

In November 2025, 2,206 single-family homes were sold in the San Antonio area, a 19 percent decline compared to the same month the year before. At the same time, homes spent an average of 86 days on the market, up 18 percent year over year. Active listings climbed to 16,114, a 14 percent increase. Together, these numbers point to a market in transition, not one in distress.

Quick Takeaway: Slower sales and longer timelines do not equal falling prices; they indicate a market adjusting to higher inventory and more deliberate decision-making.

Why Prices Aren't Rising Right Now

Several factors are keeping San Antonio home prices from climbing. First, inventory has increased. Buyers have more options within similar price ranges, which reduces the urgency that once drove bidding wars. Second, new construction is playing a major role. Builders across San Antonio, Cibolo, and the northern corridors are offering aggressive incentives such as interest-rate buydowns, closing cost assistance, and price adjustments. These incentives affect how buyers evaluate resale homes.

When buyers can compare a resale property to a new home with lower monthly payments or upfront savings, resale pricing must be realistic. This dynamic caps appreciation even in desirable neighborhoods throughout Bexar, Comal, and Guadalupe Counties.

Quick Takeaway: Higher inventory and builder incentives create a natural ceiling on price growth.

What Stabilization Means for Buyers

For buyers, stabilization is generally positive. More inventory means more choice and time to evaluate homes carefully. Negotiations are more balanced, inspections are taken seriously, and buyers are less likely to feel rushed into decisions.

However, stabilization does not mean every home is discounted. Well-priced homes in good condition still attract attention. Buyers benefit most when they understand how resale and new construction compare over the long term, including taxes, HOA fees, and location trade-offs. The Deciding to Buy a Home in San Antonio guide helps buyers look beyond surface incentives and make informed decisions based on their personal situation.

Quick Takeaway: Buyers have leverage, but smart comparisons matter more than chasing the lowest sticker price.

What Stabilization Means for Sellers

For sellers, a stabilizing market requires a shift in mindset. Pricing based on past year's peak conditions often leads to longer days on market and price reductions. Homes that are priced accurately from the start tend to perform better, even with more competition.

Condition and presentation matter more now. Buyers have options, so they quickly notice deferred maintenance or outdated features. Understanding how your home competes with new construction is critical. The Pricing Your San Antonio Home resource explains why preparation and positioning make such a difference in today's market across Greater San Antonio.

Quick Takeaway: Sellers succeed by aligning price and presentation with current conditions, not past peaks.

How Days on Market Reflect Stabilization

Longer days on market are one of the clearest signs of stabilization. With an average of 86 days on market, buyers are taking more time, and sellers are adjusting expectations. This is a return to a more typical pace rather than a signal of weakness.

Homes that enter the market with a strong strategy often attract interest early. Homes that miss the mark tend to sit longer and require adjustments. Understanding this pattern helps both sides set realistic expectations whether you are buying or selling in San Antonio, Helotes, Converse, or the surrounding areas.

Quick Takeaway: Longer timelines are normal in a stabilizing market and do not automatically indicate a problem.

"We highly recommend Tami Price for all of your real estate needs. She has been an excellent agent over the years for my family, my sister in law, and a close friend. For all 3 of us, she provided truly exceptional service. We are so thankful for her knowledge and expertise, her attention and responsiveness, as well as her friendly and warm demeanor. You can not go wrong with choosing Tami!" — Janet B.

How Builders Influence Price Stability

Builder incentives deserve special attention. When builders offer rate buydowns or closing cost credits, they effectively reduce a buyer's monthly payment without cutting the headline price. This strategy keeps reported prices steadier while still attracting buyers. Resale sellers must recognize this when evaluating competition.

For buyers, incentives can be appealing, but they should be reviewed carefully. Contract terms, timelines, and long-term costs vary significantly between builders. The Buying New Construction in San Antonio guide walks through what to consider before signing. For sellers, ignoring builder competition often leads to pricing that misses the market.

Quick Takeaway: Builder incentives stabilize prices by shifting value into financing and upfront costs rather than list price.

Who Should Pay Closest Attention Right Now

- Military families relocating to Joint Base San Antonio who need clarity and predictability

- First-time buyers stretching their budgets and comparing options

- Longtime homeowners considering a move after years of appreciation

Each group faces different opportunities and challenges, but all benefit from understanding stabilization rather than assuming either growth or decline.

"Working with Tami was an absolute pleasure! My parents retired to San Antonio 20-years ago from NE. and due to some unexpected health challenges, I needed to bring them back to NE. I vetted out Realtors, as I needed someone that could assist me from afar to get my parents house sold. Tami was the perfect agent! She was very thorough, responsive, transparent and a wealth of knowledge. With Tami's help and guidance, average sale on the market was 45+ days we sold the home in 4-days, with closing in 30-days. I could not have done this without her and I am forever grateful for her. If you are looking to buy or sell and need an agent that LISTENS and gives honest insight and guidance, Tami Price is the Realtor for you." — Michelle G.

Questions Buyers and Sellers Often Ask

Q: Does stabilization mean prices will drop next?

A: Stabilization does not automatically lead to declines. It reflects balance returning to the market.

Q: Are price reductions common right now?

A: Reductions are more common on homes that start overpriced relative to inventory and competition.

Q: Is it risky to buy in a stabilizing market?

A: Risk depends on personal timelines and finances, not just market direction.

Q: Should sellers wait for prices to rise again?

A: Waiting may or may not help; strategy and goals matter more than timing alone.

Common Misconceptions About Stabilizing Markets

A common misconception is that stabilization equals stagnation. In reality, homes continue to sell every day in San Antonio and throughout Bexar County. Another misconception is that buyers can demand extreme concessions everywhere, which is not true for well-priced homes in desirable locations.

Some sellers believe that waiting will automatically improve their outcome. Market conditions can shift in either direction, and timing the market perfectly is rarely possible. The best approach is to make informed decisions based on current conditions rather than speculation about future changes.

Important Considerations Before Making a Decision

- Your personal timeline and financial comfort

- Financing terms and long-term costs

- Neighborhood-specific supply and demand across Greater San Antonio

- Professional guidance to avoid costly assumptions

Frequently Asked Questions

Q: Are San Antonio home prices rising or falling?

A: Prices are largely flat and stabilizing, influenced by inventory and builder incentives.

Q: Is now a good time to buy in San Antonio?

A: For many buyers, yes, due to increased choice and negotiating room.

Q: Is now a good time to sell in San Antonio?

A: It can be, if pricing and preparation are handled strategically.

Q: Will builder incentives continue?

A: Incentives typically adjust with market conditions and may change over time.

Q: How do I know if a home is priced correctly in this market?

A: Compare similar recent sales, consider builder competition, and work with an agent who understands current inventory levels in your target neighborhoods.

The Bottom Line

San Antonio home prices are stabilizing as the market recalibrates. Buyers benefit from choice and leverage, while sellers succeed through accuracy and preparation. This is not a market driven by urgency or fear, but by informed decisions and realistic expectations.

Whether you are buying your first home, selling after years of ownership, or relocating to communities like Boerne, Fair Oaks Ranch, or Schertz, understanding stabilization helps you navigate with confidence.

Tami Price works with buyers and sellers across Greater San Antonio to navigate today's market with clarity, communication, and strategy. With nearly two decades of experience and over 600 five-star reviews and recommendations across multiple platforms, her approach focuses on education and honest guidance rather than pressure.

Contact Tami

Tami Price, REALTOR®, Broker Associate

📞 210 620 6681

✉️ tami@tamiprice.com

🌐 TamiPrice.com

📅 Book a Consultation

Disclaimer: This content is for educational purposes only and reflects general market conditions in Greater San Antonio at the time of writing. Real estate conditions vary by neighborhood, property type, and buyer profile. Always consult with a licensed real estate professional, lender, or legal advisor before making any real estate decision.

Categories

- All Blogs (613)

- Neighborhood Guides (9)

- About Tami Price (1)

- Affordable Housing & Community Development (2)

- Agent Qualifications and Credentials (1)

- Agent Qualifications and Experience (1)

- AI and Real Estate Tools (1)

- Alamo Heights (5)

- Alamo Heights Real Estate (1)

- Alamo Ranch (1)

- Amenities in Helotes, Texas (3)

- Apartment Market (1)

- Arts and Culture (1)

- Awards and Recognition (1)

- Best Neighborhoods to Live in Cibolo, TX (2)

- Best Neighborhoods to Live in San Antonio (16)

- Best Places to Live in Leon Valley: A Neighborhood Guide (1)

- Best Places to Live in Northeast Inner Loop: A Neighborhood Guide (1)

- Bexar County Property Tax (1)

- Boerne Home Sellers (1)

- Boerne Neighborhoods (2)

- Boerne Texas (5)

- Broadway Corridor Development (1)

- Build-to-Rent Communities (1)

- Builder Contracts & Warranties (1)

- Builder Warranties (1)

- Buyer (96)

- Buyer Due Diligence (1)

- Buyer Education (8)

- Buyer Guide (1)

- Buyer Protection Strategies (1)

- Buyer Representation (1)

- Buyer Representation Expertise (1)

- Buyer Resources (6)

- Buying a Foreclosed Home in San Antonio (10)

- Buying a Home (1)

- Buying a Home in San Antonio (5)

- Castroville, TX (9)

- Central San Antonio Development (2)

- Choosing a Real Estate Agent (1)

- Cibolo Home Sellers (1)

- Cibolo TX (14)

- Client Satisfaction (1)

- Client Testimonial (4)

- Clients review (4)

- Comal County (1)

- Commercial & Retail Development (25)

- Commercial Development (9)

- Commercial Development Impact on Home Values (1)

- Commercial Real Estate (1)

- Community Amenities (1)

- Community Development (20)

- Community Development and Real Estate (3)

- Community Events & Development (1)

- Community Investment Impact (2)

- Community News (4)

- Community Planning (1)

- Community Revitalization (1)

- Commuter Neighborhoods (1)

- Cons of Living in Helotes, TX (5)

- Converse Home Sellers (1)

- Converse TX (11)

- Converse TX Real Estate (1)

- Cost of Living Guides (1)

- Cost of Living in San Antonio TX (26)

- CPS Energy Programs (1)

- Deco District San Antonio (1)

- Down Payment Assistance (1)

- Downtown Development (2)

- Downtown Living (1)

- Downtown Revitalization (14)

- Downtown San Antonio Real Estate (5)

- Downtown San Antonio Revitalization (1)

- East Side Neighborhoods (1)

- East Side San Antonio (2)

- Economic Development (2)

- Economic Growth & Industry (1)

- Education, Texas Hill Country (1)

- Employment Corridors (1)

- Entertainment Economy (1)

- Established Communities (2)

- Events in San Antonio (208)

- Expert Advice from Tami Price, Realtor® (9)

- Family Activities (1)

- Family Living in San Antonio (1)

- Far Northwest San Antonio (1)

- Far Westside Real Estate (3)

- Featured Properties (1)

- Financial Planning (1)

- First-Time Buyers (1)

- First-Time Homebuyer Resources (3)

- First-Time Homebuyer Tips (2)

- First-Time Homebuyers (5)

- First-Time Investors (1)

- Fort Sam Houston (2)

- Fort Sam Houston Real Estate (1)

- Fort Sam Houston, TX (2)

- FSBO vs Agent Representation (1)

- Gated Communities (1)

- Green Home Upgrades (1)

- Helotes Home Sellers (1)

- Highway 151 Corridor Growth (1)

- Hill Country Development (1)

- Hill Country Living (3)

- Hill Country Market Updates (1)

- Hill Country Real Estate (2)

- Historic Districts (1)

- Holiday Attractions (1)

- Holiday Guide (1)

- Home Buying (6)

- Home Buying Guide (6)

- Home Buying Process (3)

- Home Buying Strategy (1)

- Home Buying Tips (3)

- Home Energy Efficiency San Antonio (1)

- Home Financing (2)

- Home Improvement ROI (1)

- Home Preparation (1)

- Home Pricing Strategy (1)

- Home Renovation for Resale (1)

- Home Selling (2)

- Home Selling Guide (5)

- Home Selling Strategies (2)

- Home Selling Strategy (1)

- Home Selling Tips (6)

- Home Staging and Updates (2)

- Homebuyer Education (3)

- Homebuyer Resources (1)

- Homebuying Tips (3)

- Homeowner (36)

- Homeowner Tax Benefits (1)

- Homeownership Costs (1)

- Homes for Sale (1)

- Homes for sale near Lackland AFB (5)

- Homes Near Military Bases (1)

- Housing (1)

- Housing Market Updates (2)

- How to Buy a House in San Antonio TX (49)

- I-10 Corridor (1)

- Incorporated Cities (4)

- Industrial Investment Impact (1)

- Industry News (2)

- Infrastructure & Growth Projects (26)

- Infrastructure and Sustainability (1)

- Infrastructure Development (1)

- Infrastructure Investment (1)

- Infrastructure Updates (2)

- Invest in San Antonio (47)

- Investment Opportunities (2)

- Investment Property San Antonio (1)

- JBSA (4)

- JBSA Real Estate (4)

- Joint Base San Antonio (5)

- Joint Base San Antonio Housing (1)

- La Cantera Retail Development (1)

- Lackland AFB (6)

- Lackland AFB Housing (1)

- Lera MLS (1)

- Lifestyle & Community Growth (16)

- Lifestyle & Local Growth (12)

- Lifestyle Amenities (1)

- Lifestyle Communities (1)

- Listing Preparation (1)

- Live Oak (2)

- Living in San Antonio, TX (53)

- Living Near Randolph AFB (6)

- Local Attractions (2)

- Local Business & Development (9)

- Local Business & Economy (3)

- Local Business Spotlight (17)

- Local Business Support (4)

- Local Development (3)

- Local Market Insights (3)

- Local News (1)

- Local News Around San Antonio (1)

- Local Real Estate News (1)

- Loop 1604 Corridor Growth (2)

- Loop 410 Corridor Development (1)

- Luxury Communities (1)

- Luxury Retail San Antonio (1)

- Major Developments (1)

- Making Offers on Homes (1)

- Market Analysis (1)

- Market Conditions (7)

- Market Timing (1)

- Market Trends (7)

- Market Update (4)

- Market Updates (9)

- Master Planned Communities (6)

- Medical Center Area Real Estate (1)

- Military & Economic Impact (3)

- Military Family Resources (1)

- Military Homebuying (1)

- Military Housing (2)

- Military Housing Market in Texas (17)

- Military Life in San Antonio (2)

- Military PCS Relocations (1)

- Military Real Estate (1)

- Military Relocation (3)

- Military Relocation & VA Loans (9)

- Military Relocation San Antonio (3)

- Military Relocation Services (3)

- Military Relocation to San Antonio (50)

- Military Relocations (17)

- Military Relocations & VA Home Loans (5)

- Mixed-Income Housing (1)

- MLS Accuracy & Data Transparency (1)

- Mortgage Programs (1)

- Mothers Day in San Antonio (2)

- Move to Boerne TX (19)

- Move to Castroville TX (12)

- Move to Converse TX (17)

- Move to New Braunfels (1)

- Move to North San Antonio (19)

- Move to San Antonio TX (74)

- Move to Selma TX (20)

- Move to Shertz TX (14)

- Move to Texas (54)

- Move-In Ready Homes (1)

- Move-In Ready Homes San Antonio (2)

- Move-Up Buyers (1)

- Moving to Helotes, TX (18)

- Moving to San Antonio (70)

- Neighborhood Amenities (1)

- Neighborhood Guides (7)

- Neighborhood Investment (1)

- Neighborhood News (2)

- Neighborhood Revitalization (2)

- Neighborhood Updates (1)

- Neighborhoods near Randolph AFB (13)

- New Braunfels (3)

- New Braunfels Real Estate (1)

- New Construction (21)

- New Construction Homes (5)

- New Construction Homes San Antonio (1)

- New Construction Without Customization (1)

- New Construction Without the Wait (1)

- New Development (3)

- New Listing (8)

- New Restaurants (2)

- News (211)

- News & updates (213)

- North Central San Antonio (4)

- North San Antonio (6)

- North San Antonio Real Estate (3)

- North Side Neighborhoods (1)

- North Side San Antonio Development (1)

- Northeast Inner Loop (1)

- Northeast Inner Loop Neighborhoods (1)

- Northeast San Antonio (1)

- Northwest San Antonio (6)

- Northwest San Antonio Development (1)

- Northwest San Antonio Growth (1)

- Northwest San Antonio Real Estate (1)

- Northwood (2)

- Olympia Hills (2)

- Parks and Recreation (2)

- PCS Guide (2)

- PCS Moves (2)

- PCS Moves to Joint Base San Antonio (2)

- PCS Planning (1)

- PCS Randolph AFB (18)

- PCS Relocation (1)

- PCS San Antonio (47)

- PCS to San Antonio (43)

- Pearl District Area Real Estate (1)

- Places to Eat Near Randolph AFB (2)

- Pre-Listing Preparation (2)

- Pre-Listing Process (1)

- Pricing and Marketing Strategy (1)

- Professional Awards and Achievements (1)

- Professional Real Estate Representation (1)

- Property Tax Exemptions Texas (1)

- Property Value Enhancement (1)

- pros and cons living in Converse TX (4)

- Pros and Cons Living in Selma TX (7)

- Pros and Cons of Living in Castroville, TX (5)

- Pros and Cons of Living in San Antonio (34)

- Purchase Negotiation (1)

- Quick Close Real Estate (1)

- Randolph AFB Neighborhoods (1)

- Real Estate (1)

- Real Estate Agent Recognition (1)

- Real Estate Agent Selection (2)

- Real Estate Agent Value (1)

- Real Estate Consultation (1)

- Real Estate Finance (1)

- Real Estate Financing (1)

- Real Estate Impact (1)

- Real Estate Investment San Antonio (2)

- Real Estate Legal Issues (1)

- Real Estate Market Insights (2)

- Real Estate Market Trends (3)

- Real Estate Professional Designations (1)

- Real Estate Technology & Trends (2)

- Real Estate Tips and Guides (2)

- Real Estate Trends (4)

- RealTrends Verified (1)

- Regional Real Estate (1)

- Relocating to San Antonio (2)

- Relocation Resources (1)

- Relocation to San Antonio (56)

- Resale Properties (1)

- Retire in Boerne TX (12)

- Retire in San Antonio (38)

- SABOR (21)

- San Antonio Area Listings (1)

- San Antonio Business Growth (1)

- San Antonio Buyer Resources (2)

- San Antonio Communities (2)

- San Antonio Community Events (1)

- San Antonio Community News (1)

- San Antonio Data Center Development (1)

- San Antonio Development (5)

- San Antonio Development & East Side Real Estate (1)

- San Antonio Dining and Lifestyle (2)

- San Antonio East Side Development (1)

- San Antonio Employment Growth (1)

- San Antonio Food & Community Development (2)

- San Antonio Growth (8)

- San Antonio Home Buying and Selling (2)

- San Antonio Home Buying Guide (4)

- San Antonio Home Improvement (2)

- San Antonio Home Sellers (2)

- San Antonio Homeowner Guide (1)

- San Antonio Homeowner Resources (1)

- San Antonio Housing Market & Mortgage Financing (2)

- San Antonio Housing Market Analysis (1)

- San Antonio Housing Trends & Market Analysis (3)

- San Antonio Industrial Development (1)

- San Antonio Industrial Policy (1)

- San Antonio Investment Properties (2)

- San Antonio Job Market (1)

- San Antonio Lifestyle Amenities (1)

- San Antonio Listing (1)

- San Antonio Market (1)

- San Antonio Military Relocation (2)

- San Antonio Neighborhoods (38)

- San Antonio New Construction & Master-Planned Communities (4)

- San Antonio New Home Communities (1)

- San Antonio News (220)

- San Antonio North Side Development (1)

- San Antonio Parks (1)

- San Antonio Property Investment (1)

- San Antonio Property Taxes (1)

- San Antonio Real Estate (35)

- San Antonio Real Estate Agents (2)

- San Antonio Real Estate Excellence (1)

- San Antonio Real Estate Guide (3)

- San Antonio Real Estate Market (29)

- San Antonio Real Estate Market Analysis (6)

- San Antonio Real Estate News (2)

- San Antonio Restaurant News (2)

- San Antonio Restaurant Openings (1)

- San Antonio Seller Resources (1)

- San Antonio Spec Homes (1)

- San Antonio Spurs Community Programs (1)

- San Antonio Suburbs (1)

- San Antonio Transportation (2)

- San Antonio University Area Housing (1)

- San Antonio Urban Living (7)

- San Antonio West Side Development (2)

- San Antonio Zoning Policy (1)

- Schertz Home Sellers (1)

- Schertz, TX (13)

- School Districts (1)

- Sell Home In San Antonio TX (63)

- Seller (83)

- Seller Education (5)

- Seller Guide (1)

- Seller Representation Expertise (1)

- Seller Resources (5)

- Seller Strategy (2)

- Seller Tips (1)

- Sellers (1)

- Selling A Home in San Antonio (61)

- Selling Your San Antonio Home (3)

- Selma TX (10)

- Single-Story Homes (1)

- South San Antonio Real Estate (1)

- South Side Economic Growth (1)

- Southtown (1)

- Southwest San Antonio Real Estate (1)

- Spec Homes and Inventory Homes (1)

- Spurs Arena Project Marvel (1)

- Stone Oak Community News (3)

- Suburban Housing Growth (12)

- Suburban Living (1)

- Technology Growth (3)

- Technology Sector Growth (1)

- Terrell Hills (4)

- Texas Homestead Exemption (1)

- The Dominion Real Estate (1)

- The Rim Area Real Estate (1)

- Things to do in San Antonio TX (22)

- Things to do Near Randolph AFB (5)

- Time-Sensitive Home Buying (1)

- Tips for Buying New Construction (8)

- Tobin Hill Neighborhoods (1)

- Top Real Estate Agent in San Antonio (3)

- Tourism and Economic Development (1)

- Transportation Infrastructure (1)

- Universal City (2)

- Urban Corridor Real Estate (1)

- Urban Development (3)

- Urban Living (2)

- Urban Real Estate (1)

- Urban Renewal Projects (1)

- Urban Revitalization San Antonio (1)

- Utility Cost Reduction (1)

- UTSA Campus Development (1)

- VA Home Loan Benefits (2)

- VA Loan Assumptions (3)

- VA loan benefits (26)

- VA Loan Guidance (1)

- VA Loans (10)

- VA Loans and Military Benefits (2)

- VA Loans and Military Home Buying (2)

- VA Loans San Antonio (44)

- VET Benefits Living in San Antonio (4)

- Veterans Resources (1)

- Village Northwest (1)

- Walkable Communities (1)

- week in sales (21)

- Weekly Sales Report (21)

- West San Antonio (2)

- West San Antonio Development (1)

- West San Antonio Real Estate (3)

- West San Antonio Real Estate Market (2)

- West Side Infrastructure Planning (1)

- West Side Real Estate (1)

- West Side San Antonio (2)

Recent Posts