San Antonio Real Estate Market Update: December 2025 Weekly Sales Trends for Buyers and Sellers

The San Antonio real estate market continues demonstrating steady movement as December 2025 progresses, even during a traditionally quieter time of year when many assume housing activity pauses for the holidays. Recent weekly sales data from LERA MLS offers valuable insight into pricing trends, buyer activity, and overall market direction across the city. By analyzing multiple consecutive weeks of sales performance, buyers and sellers can better understand where opportunities and leverage currently exist rather than relying on assumptions about seasonal slowdowns.

The weeks spanning December 1 through December 21, 2025, reflect consistent demand, rising transaction counts, and notable price movements that matter for anyone considering buying a home in San Antonio or selling a home in San Antonio. These data points provide more immediate market intelligence than monthly or quarterly reports that smooth over weekly variations and may not capture current buyer behavior accurately.

Understanding weekly market dynamics helps both buyers and sellers calibrate strategies for current conditions rather than operating on outdated assumptions. Buyers benefit from recognizing when competition intensifies and what price ranges are moving. Sellers benefit from understanding buyer activity levels and pricing trends that affect how to position their properties. Both parties gain advantage from data driven decision making over speculation or headline driven reactions.

This market update explores what December 2025 weekly sales data reveals, how transaction volumes have progressed through the month, what pricing trends indicate about buyer and seller dynamics, how these patterns affect strategy for both parties, and what the data suggests about market direction heading into 2026. Whether actively searching for homes, preparing to list, or monitoring market conditions, current data provides actionable intelligence for informed decisions.

What Does December 2025 Weekly Sales Data Show?

Examining specific weekly sales data provides granular insight into market activity that broader reports cannot capture. Understanding the actual numbers helps buyers and sellers recognize patterns and calibrate expectations. The December 2025 data reveals consistent activity with meaningful trends.

During the week of December 1 through December 7, 2025, San Antonio recorded 360 homes sold according to LERA MLS data. The average sales price reached $388,770 while the median sales price was $332,750. These figures establish the baseline for the month and demonstrate that buyer activity remained present despite the holiday season beginning.

Q: How did sales activity progress through December 2025?

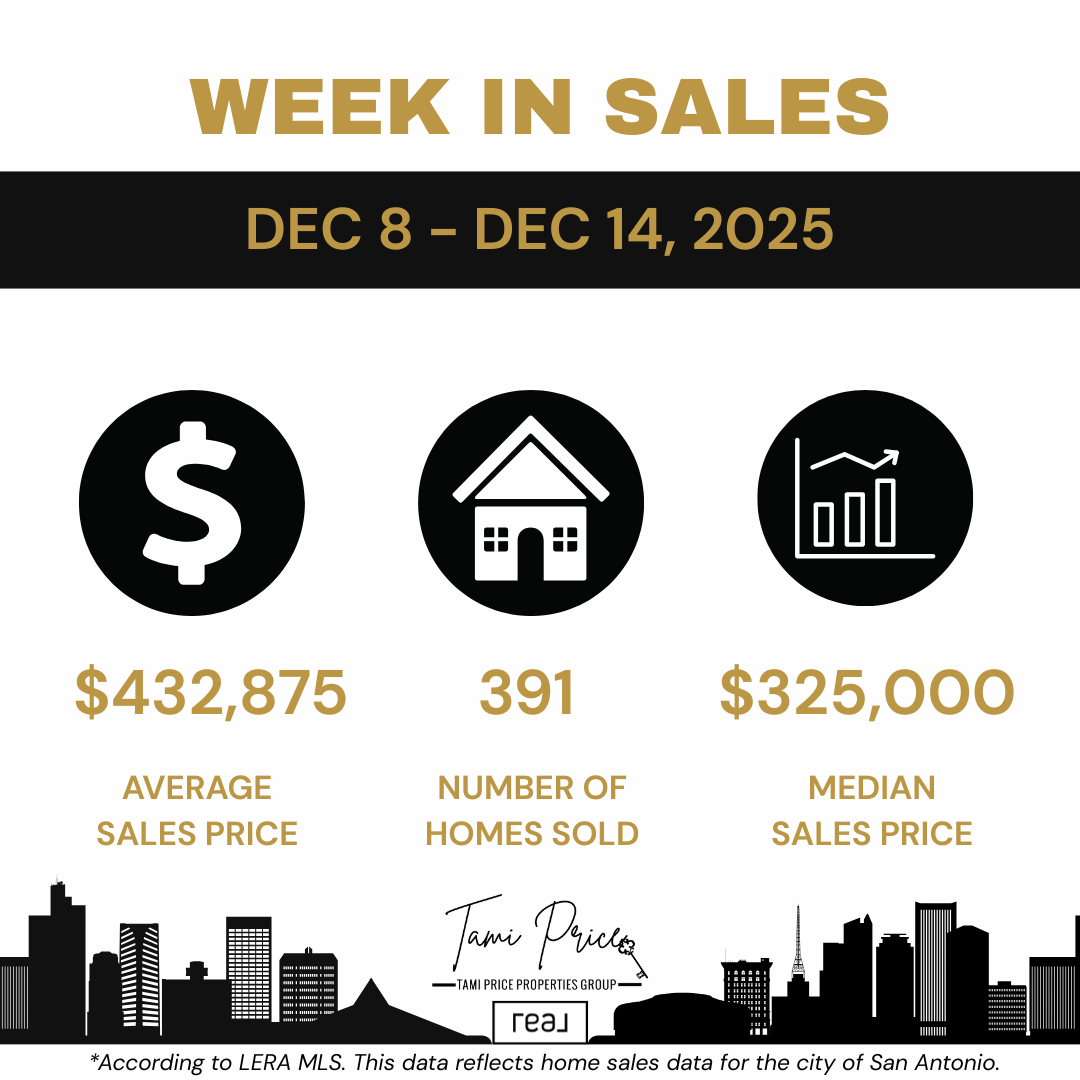

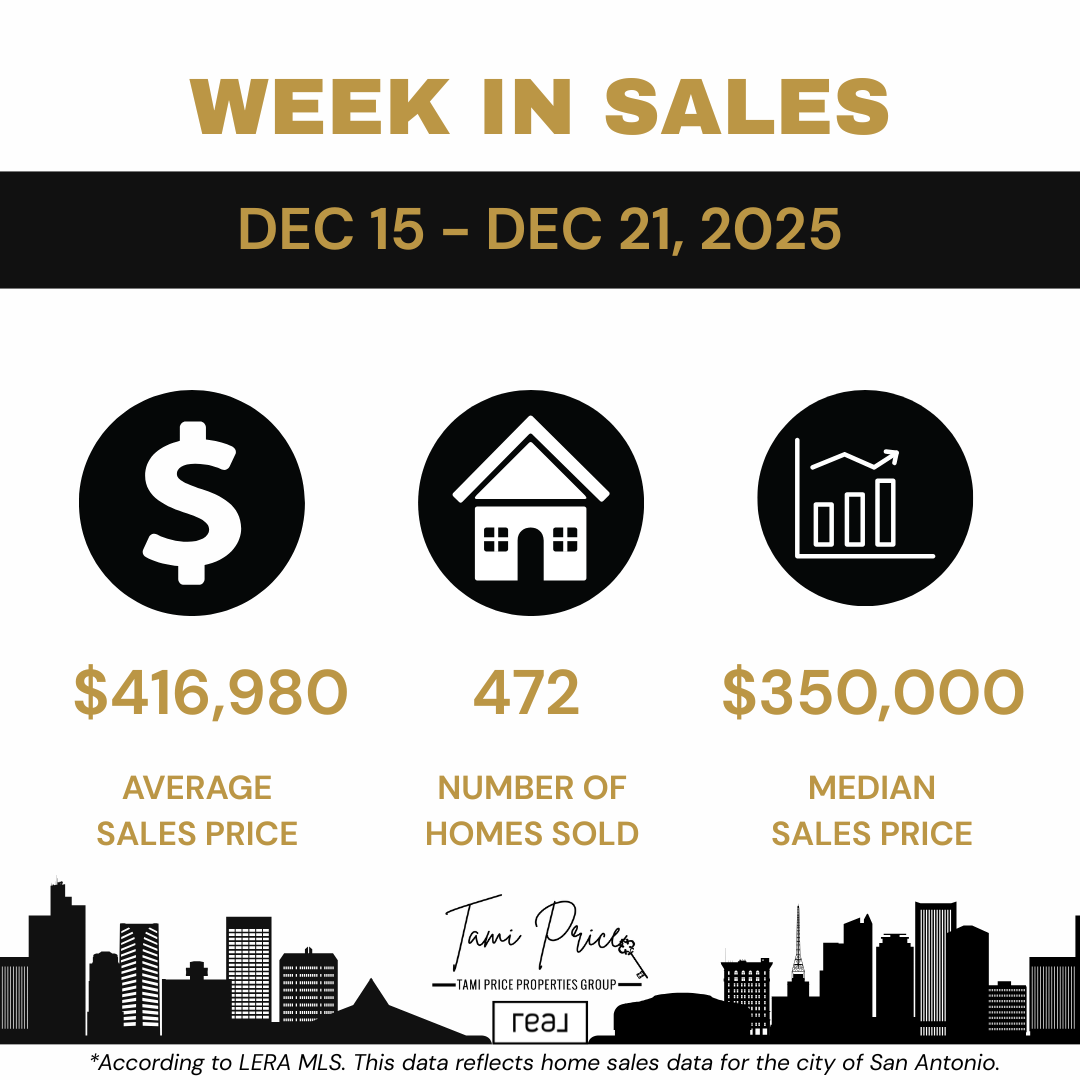

A: The following week of December 8 through December 14 showed increased activity with 391 homes sold, representing approximately 8.6 percent increase in transaction volume. The average sales price rose significantly to $432,875 while the median price adjusted to $325,000. The week of December 15 through December 21 continued the upward momentum with 472 homes sold citywide, marking 31 percent increase from the first week of the month. The average sales price was $416,980 with median price reaching $350,000.

This progression demonstrates that buyer engagement strengthened rather than weakened as December progressed. The assumption that holiday weeks see dramatically reduced activity does not match the actual data, which shows consistent and even increasing transaction volume.

December 2025 weekly summary:

- Week of Dec 1-7: 360 homes sold, $388,770 average, $332,750 median

- Week of Dec 8-14: 391 homes sold, $432,875 average, $325,000 median

- Week of Dec 15-21: 472 homes sold, $416,980 average, $350,000 median

- Transaction volume increasing through month

- Median price trending upward

- Average price fluctuating with mix variation

What Do Rising Transaction Volumes Indicate?

The consistent increase in weekly sales volume through December provides meaningful signal about market conditions. Understanding what rising transaction counts indicate helps both buyers and sellers interpret current dynamics. Volume trends often reveal more about market health than price movements alone.

Rising transaction volume indicates that buyers remain willing and able to complete purchases despite seasonal timing and ongoing interest rate environment. The 31 percent increase from the first to third week of December suggests motivated buyer activity rather than a market waiting for different conditions. Buyers who wanted to close before year end appear to have acted on that motivation.

Q: What drives transaction volume increases during December?

A: Several factors contribute to December activity including buyers seeking to close before year end for tax purposes, relocating buyers with job start dates in January, military families completing PCS moves, and buyers who have been searching and found suitable properties. The consistency of activity suggests these motivations outweigh holiday distractions for serious buyers. Additionally, motivated sellers listing during December often attract serious buyers rather than casual browsers.

The volume increase also indicates that inventory exists to support transactions. Sales cannot occur without available homes, and 472 closed transactions in a single week demonstrates that sufficient supply exists to match buyer demand. This balance supports continued market activity rather than the stagnation that either extreme inventory shortage or surplus would create.

Volume trend implications:

- Buyer willingness and ability demonstrated

- Year end motivations driving activity

- Serious buyers outweighing seasonal hesitation

- Inventory sufficient to support transactions

- Market balance enabling consistent sales

- Activity exceeding typical December assumptions

How Should Buyers Interpret the December 2025 Data?

Buyers evaluating the San Antonio market benefit from understanding what current data reveals about their competitive position and opportunities. The December numbers provide specific guidance for buyer strategy. Interpreting data correctly helps avoid both overreaction and underestimation of market conditions.

The rising transaction volume confirms that opportunities exist but preparation matters more than ever. Increased weekly sales signal active competition, particularly for well priced homes in popular neighborhoods. Buyers who assume December offers easy pickings may find themselves surprised by continued competition for desirable properties.

Q: What does the median price trend indicate for buyers?

A: The median sales price movement from $332,750 in the first week to $350,000 in the third week suggests that entry level and mid range homes continue moving quickly. Median price increases when higher priced homes represent larger share of sales or when prices across all segments rise. In this case, the $17,250 median increase over three weeks indicates sustained demand in segments that typical buyers target. Buyers seeking properties near the median should recognize continued competition rather than assuming softening.

Buyers who are pre-approved, flexible on timing, and realistic about expectations position themselves better for favorable outcomes. Working with professionals who understand pricing strategy, negotiation leverage, and neighborhood specific trends helps buyers avoid overpaying or missing opportunities.

Buyer implications from data:

- Competition remains active

- Well priced homes moving quickly

- Median price trend showing demand strength

- Preparation providing competitive advantage

- Pre-approval essential for serious buyers

- Local expertise aiding decision making

What Does the Data Signal for San Antonio Home Sellers?

Sellers evaluating whether current conditions favor listing benefit from understanding what December data reveals about buyer activity and pricing dynamics. The numbers offer encouraging signals for sellers who approach the market strategically. Data interpretation guides listing decisions.

Higher transaction counts across multiple December weeks indicate that buyers continue moving forward even during the holiday season. The assumption that listing during December means fewer buyers does not match actual activity levels. Homes that are priced accurately and presented well continue attracting attention and closing successfully.

Q: What does the rising median price mean for sellers?

A: The median sales price increase to $350,000 during the week of December 15 through 21 shows that well positioned homes are commanding strong values. Sellers who align pricing with current market conditions rather than peak season expectations or outdated assumptions are more likely to see timely results. The data suggests buyers are willing to pay appropriate prices for homes that meet their criteria.

Strategy matters more than timing alone. Sellers who understand buyer demand, local inventory levels, and recent comparable sales can position their homes competitively and avoid extended days on market. The December activity levels demonstrate that serious buyers are present; attracting them requires accurate pricing and effective marketing.

Seller implications from data:

- Buyer activity strong during December

- Holiday timing not preventing sales

- Accurate pricing attracting buyers

- Median prices supporting values

- Strategy more important than timing

- Market rewarding preparation

Why Do Weekly Trends Matter More Than Monthly Headlines?

Many buyers and sellers focus on monthly or quarterly market reports, but weekly data often provides clearer picture of real time market behavior. Understanding why weekly analysis matters helps market participants make more informed decisions. The granularity reveals patterns that aggregated reports obscure.

Monthly reports average four or five weeks of activity, smoothing variations that might indicate trends or opportunities. A month showing flat overall activity might contain weeks of increasing momentum that signal changing conditions. Conversely, a strong monthly number might mask weakening in recent weeks. Weekly data provides more current intelligence.

Q: How do weekly trends reveal market direction better than monthly data?

A: Short term trends reveal how buyers are responding to pricing, interest rates, and inventory right now rather than how they behaved on average over the past 30 or 90 days. The December progression from 360 to 391 to 472 weekly sales shows clear momentum that a single monthly number would not reveal. Buyers and sellers acting in late December benefit from knowing this trajectory rather than waiting for January monthly report summarizing December average.

In San Antonio, the steady increase in homes sold over consecutive December weeks highlights resilience and ongoing demand. While pricing adjusts from week to week reflecting the specific mix of homes sold, consistent sales volume suggests balanced market where informed decisions lead to successful outcomes.

Weekly data advantages:

- More current than monthly reports

- Reveals trends within months

- Shows real time buyer response

- Captures momentum changes

- Informs timely decisions

- Reveals patterns aggregation obscures

How Do Average and Median Prices Differ and Why Does It Matter?

Understanding the difference between average and median sales prices helps buyers and sellers interpret market data accurately. The December 2025 numbers show different patterns in these two metrics, which reveals important market dynamics. Misunderstanding these measures leads to incorrect conclusions.

Average sales price calculates total sales volume divided by number of transactions. A few high priced sales can significantly raise the average even if most transactions occur at lower prices. Median sales price represents the middle transaction when all sales are ranked by price, with half selling above and half below. Median better represents typical transaction experience.

Q: What explains the different patterns in December's average versus median prices?

A: The average price fluctuated from $388,770 to $432,875 to $416,980 across the three weeks while median moved from $332,750 to $325,000 to $350,000. The significant average increase in week two likely reflects one or more high value transactions that pulled the average upward without representing broader market movement. The median's progression shows more consistent pattern indicating typical buyer experience.

For most buyers and sellers, median provides more relevant benchmark since it represents the actual middle of the market rather than being distorted by outliers. The median increase to $350,000 in the third week suggests genuine strengthening in the typical price range rather than statistical artifact from luxury sales.

Price metric differences:

- Average affected by outliers

- Median representing typical transaction

- Week two average spike likely from luxury sales

- Median progression showing clearer trend

- Most buyers using median as relevant benchmark

- Both metrics providing different insights

What Market Conditions Does the December Data Reflect?

The December 2025 weekly data reflects specific market conditions that buyers and sellers should understand. Interpreting what conditions produce these numbers helps market participants recognize their environment. Context enhances data interpretation.

The consistent transaction volume and relatively stable pricing indicate balanced market conditions where neither buyers nor sellers hold overwhelming advantage. Buyers have options to evaluate without desperate competition for every listing. Sellers can attract buyers without dramatic price reductions or extended waiting. This balance enables transactions that serve both parties.

Q: How do current conditions compare to recent San Antonio market history?

A: Current conditions differ substantially from the intense seller's market of 2021-2022 when inventory shortages created extreme competition and rapid price increases. They also differ from historical buyer's markets when excess inventory gave buyers substantial leverage. The December 2025 data shows market that has normalized from pandemic era extremes while maintaining healthy activity levels. This normalization supports sustainable transactions rather than the frenzy or stagnation of extreme conditions.

The balance means strategy matters more than simply participating. Buyers benefit from thoughtful evaluation and competitive offers rather than panic purchases. Sellers benefit from accurate pricing and effective presentation rather than assuming any approach will work. Professional guidance helps both parties navigate balanced conditions successfully.

Current market conditions:

- Balanced between buyer and seller leverage

- Consistent transaction volume

- Stable pricing with normal variation

- Normalization from pandemic extremes

- Strategy importance increased

- Professional guidance beneficial

How Does This Data Apply to Different San Antonio Neighborhoods?

While citywide data provides useful overview, San Antonio comprises diverse neighborhoods with varying conditions. Understanding how aggregate data relates to specific areas helps buyers and sellers apply insights appropriately. Local variation requires localized analysis.

Different neighborhoods within Greater San Antonio may experience stronger or weaker demand, faster or slower sales, and different price dynamics than citywide averages suggest. Areas near Schertz, Cibolo, and Converse attract military buyers with different patterns than Boerne or Helotes areas. Price ranges also vary substantially across the metropolitan area.

Q: Should buyers and sellers rely solely on citywide data for decisions?

A: No, citywide data provides context but specific neighborhood analysis drives accurate pricing and strategy. A neighborhood trending above citywide average may support stronger seller positioning while one underperforming average may favor buyers. Understanding your specific micro market within the broader San Antonio context leads to better decisions than applying aggregate statistics uniformly.

Working with professionals who track neighborhood level data and understand local dynamics helps translate citywide trends into specific guidance. The December citywide numbers confirm overall market health; neighborhood analysis determines how that health manifests in your specific situation.

Neighborhood considerations:

- Citywide data providing context only

- Local variation substantial

- Different areas attracting different buyers

- Price ranges varying across metro

- Micro market analysis essential

- Professional guidance translating data

What Should Buyers Do Based on Current Market Data?

Buyers seeking to act on current market intelligence benefit from specific strategic guidance. The December data informs particular approaches that align with demonstrated conditions. Translating data into action produces better outcomes than passive observation.

The rising transaction volume indicates that well prepared buyers are finding and securing properties. Passive approaches waiting for conditions to change may result in missed opportunities as other buyers continue acting. Active preparation positions buyers to capitalize when suitable properties appear.

Q: What specific preparation should buyers prioritize now?

A: Pre-approval represents essential preparation, demonstrating to sellers that offers are backed by lending commitment rather than hope. Understanding your actual budget based on current rates rather than theoretical calculations helps target appropriate properties. Defining priorities and flexibility helps move quickly when opportunities arise. Building relationship with experienced representation who can act quickly and negotiate effectively provides competitive advantage.

Buyers should also set realistic expectations based on current data. The median price of $350,000 in the most recent week provides benchmark for what typical transactions look like. Properties significantly below this median will likely face competition while those above may offer more negotiating room. Understanding where your target falls relative to current activity informs strategy.

Buyer action items:

- Secure pre-approval demonstrating commitment

- Understand actual budget at current rates

- Define priorities and areas of flexibility

- Establish professional representation relationship

- Set realistic expectations from data

- Prepare to act when opportunities appear

What Should Sellers Consider Based on Current Market Data?

Sellers evaluating listing timing and strategy benefit from understanding what current data suggests about their prospects. The December numbers inform specific approaches for sellers seeking successful outcomes. Data driven strategy outperforms assumption based approaches.

The consistent buyer activity through December indicates that listing now can produce results rather than requiring wait until spring. Sellers with reasons to act sooner, whether life circumstances, financial needs, or relocation requirements, can proceed with confidence that buyers are present. The data does not support assumptions that December listing guarantees failure.

Q: How should sellers approach pricing based on current data?

A: The median price trend provides guidance but individual property pricing requires specific comparable analysis. Properties similar to the median selling range should expect active buyer interest when priced appropriately. Properties significantly above median need compelling value proposition to attract buyers with more options. Understanding where your property fits relative to current activity helps set realistic expectations.

Sellers should also recognize that 472 transactions in a single week means buyers are actively choosing among available options. Properties that show well, photograph professionally, and present accurate information will outperform those with deferred maintenance, poor presentation, or misleading descriptions. Preparation affects which listings attract the active buyers the data confirms are present.

Seller action items:

- Recognize buyer activity supporting listing now

- Price based on comparable analysis not assumptions

- Understand property position relative to market

- Prepare property for buyer evaluation

- Invest in professional marketing

- Work with experienced representation

Expert Insight from Tami Price

"The December 2025 weekly data confirms what we've seen throughout the year: San Antonio's housing market rewards preparation and strategy over timing speculation," says Tami Price, REALTOR® and Broker Associate with Real Broker, LLC. "The progression from 360 to 472 weekly sales through December demonstrates that buyers remain active even during what many assume is a slow season. Sellers who understand this and price accurately are achieving successful outcomes."

Price brings nearly two decades of experience and approximately 1,000 closed transactions to her work with buyers and sellers throughout San Antonio, Schertz, Cibolo, Helotes, Converse, and Boerne. Her data driven approach helps clients interpret market information and translate it into effective strategies.

"I advise buyers to focus on data driven decision making rather than headlines," Price explains. "Weekly shifts in pricing and volume often reflect buyer behavior and transaction mix, not instability. Understanding these nuances can make significant difference in outcomes. The median price increase to $350,000 in the most recent week shows strength in the segments where most buyers are active."

Her recognition as a RealTrends Verified Top Agent and 14-time Five Star Professional Award Winner reflects consistent client satisfaction serving buyers and sellers through various market conditions.

"For sellers, strategy matters more than timing alone," Price notes. "The data shows buyers are present and active. Sellers who understand demand levels, local inventory, and recent comparable sales can position competitively and avoid extended days on market. The December activity proves that well prepared listings attract qualified buyers regardless of calendar timing."

Three Key Takeaways

1. December 2025 Weekly Sales Volume Increased Consistently from 360 to 472 Homes Sold, Demonstrating Active Buyer Engagement Through the Holiday Season

The 31 percent increase in weekly transaction volume from early to mid-December contradicts assumptions that holiday timing stalls market activity. Buyers with year end motivations, relocations, and purchase readiness continued closing transactions at increasing rates. This activity level indicates market health that rewards prepared participants.

2. Median Sales Price Rose from $332,750 to $350,000 Through December, Indicating Sustained Demand in Typical Buyer Price Ranges

The median price progression shows strengthening in market segments where most buyers are active rather than statistical artifacts from outlier transactions. Those considering buying a home in San Antonio should recognize competition remains present for well priced properties near the median. Sellers can take confidence that appropriately priced homes attract buyer interest.

3. Weekly Data Provides More Current Market Intelligence Than Monthly Reports, Enabling Better Timed Decisions for Both Buyers and Sellers

The December weekly progression reveals momentum that monthly averages would obscure. Both buyers and sellers benefit from understanding current trends rather than waiting for aggregated reports. Those considering selling a home in San Antonio can see that buyer activity supports listing decisions now rather than requiring spring timing.

Frequently Asked Questions

Q: How many homes sold in San Antonio during December 2025?

A: During the three weeks from December 1 through December 21, 2025, San Antonio recorded 360, 391, and 472 homes sold respectively according to LERA MLS data. The total for these three weeks was 1,223 transactions with increasing weekly volume through the month.

Q: What was the median home price in San Antonio in December 2025?

A: The median sales price ranged from $325,000 to $350,000 across the three December weeks analyzed, with the most recent week (December 15-21) showing $350,000 median. This represents the middle transaction price with half of homes selling above and half below.

Q: Is December a good time to buy a home in San Antonio?

A: The December 2025 data shows active buyer competition with rising transaction volumes, indicating that serious buyers are present and completing purchases. December can offer opportunities as some sellers are motivated and competition may be less intense than spring, but well priced homes still attract multiple interested buyers.

Q: Is December a good time to sell a home in San Antonio?

A: The data supports December selling with 472 homes closing in a single week during mid-December. Buyers are active despite holiday timing, and appropriately priced homes continue attracting interest. Sellers with reasons to act need not wait for spring based on seasonal assumptions.

Q: What is the difference between average and median home price?

A: Average price calculates total sales divided by transactions, which outliers can distort. Median represents the middle transaction when ranked by price. For December 2025, average fluctuated more dramatically ($388,770 to $432,875 to $416,980) than median ($332,750 to $325,000 to $350,000), likely due to varying luxury home sales affecting the average.

Q: Are San Antonio home prices going up or down?

A: The December 2025 weekly data shows median prices trending upward from $332,750 to $350,000 over three weeks. This suggests stable to slightly increasing prices rather than decline. Average prices fluctuated based on transaction mix but do not indicate declining market conditions.

Q: How does San Antonio's December market compare to the rest of the year?

A: December typically shows somewhat reduced volume compared to peak spring months, but the 2025 December data demonstrates continued healthy activity. The increasing weekly volume contradicts expectations of dramatic seasonal slowdown.

Q: Should I wait until 2026 to buy or sell in San Antonio?

A: The decision to act depends on individual circumstances rather than calendar timing. The December data shows active market conditions for both buyers and sellers. Those with reasons to act now can do so with confidence that the market supports transactions. Those without urgency can evaluate whether conditions might change, though predicting market timing proves consistently difficult.

The Bottom Line

The San Antonio housing market remains active and opportunity driven as 2025 concludes. Rising weekly sales volume, stable to increasing median prices, and ongoing buyer engagement signal market conditions that reward preparation, strategy, and local expertise. The December data contradicts assumptions that holiday timing pauses market activity, with 472 homes selling in a single mid-December week demonstrating sustained buyer commitment.

Whether buying or selling, understanding weekly trends provides meaningful advantage over relying on assumptions or waiting for monthly reports. The data shows buyers are present and sellers achieving results. Success depends more on preparation and strategy than on timing the market perfectly.

For both buyers and sellers, working with experienced representation who tracks current data and understands local neighborhood dynamics translates market intelligence into effective action. The numbers confirm opportunity exists; capturing that opportunity requires informed approach.

Contact Tami Price, REALTOR®

Whether interpreting market data for your specific situation, preparing to buy, or considering listing your home, working with an experienced REALTOR® provides guidance through complex decisions. Tami Price brings local market knowledge, data driven analysis, and professional dedication to help clients understand conditions and achieve their goals.

From first time buyers to sellers evaluating timing, personalized service makes the difference in transaction outcomes.

Tami Price, REALTOR®, Broker Associate

📞 210-620-6681

Tami Price's Specialties

- Comprehensive Buyer and Seller Representation

- Strategic Pricing and Market Analysis

- Professional Property Marketing

- Military Relocations and PCS Moves

- VA Loan Guidance and Assumptions

- New Construction Navigation

- First Time Buyer Education

- Move Up and Downsizing Transitions

- Residential Real Estate Throughout San Antonio, Schertz, Cibolo, Helotes, Converse, and Boerne

Disclaimer

This content reflects market conditions based on LERA MLS data for the city of San Antonio for the weeks indicated. Real estate conditions vary by neighborhood, property type, and price range. Weekly data provides snapshot that may not represent all market segments or predict future conditions. Past performance does not guarantee future results. Always consult with a licensed real estate professional for guidance specific to your situation. Tami Price, REALTOR®, and Real Broker, LLC make no warranties regarding accuracy, completeness, or applicability of information to specific circumstances.

Categories

- All Blogs (632)

- Neighborhood Guides (15)

- About Tami Price (1)

- Affordable Housing & Community Development (3)

- Agent Qualifications and Credentials (1)

- Agent Qualifications and Experience (1)

- AI and Real Estate Tools (1)

- Alamo Heights (5)

- Alamo Heights Real Estate (1)

- Alamo Ranch (1)

- Amenities in Helotes, Texas (3)

- Apartment Market (1)

- Arts and Culture (1)

- Awards and Recognition (1)

- Best Neighborhoods to Live in Cibolo, TX (2)

- Best Neighborhoods to Live in San Antonio (16)

- Best Places to Live in Leon Valley: A Neighborhood Guide (1)

- Best Places to Live in Northeast Inner Loop: A Neighborhood Guide (1)

- Bexar County Property Tax (1)

- Bexar County Real Estate (1)

- Boerne Home Sellers (1)

- Boerne Neighborhoods (2)

- Boerne Texas (7)

- Broadway Corridor Development (1)

- Build-to-Rent Communities (1)

- Builder Contracts & Warranties (1)

- Builder Warranties (1)

- Buyer (95)

- Buyer Due Diligence (1)

- Buyer Education (9)

- Buyer Guide (2)

- Buyer Protection Strategies (1)

- Buyer Representation (1)

- Buyer Representation Expertise (1)

- Buyer Resources (6)

- Buying a Foreclosed Home in San Antonio (10)

- Buying a Home (1)

- Buying a Home in San Antonio (5)

- Castroville, TX (8)

- Central San Antonio Development (2)

- Central Texas Growth (1)

- Choosing a Real Estate Agent (1)

- Cibolo Home Sellers (1)

- Cibolo TX (13)

- Client Satisfaction (1)

- Client Testimonial (4)

- Clients review (4)

- Comal County (1)

- Commercial & Retail Development (26)

- Commercial Development (11)

- Commercial Development Impact on Home Values (1)

- Commercial Real Estate (1)

- Community Amenities (2)

- Community Development (22)

- Community Development and Real Estate (3)

- Community Events & Development (1)

- Community Infrastructure (1)

- Community Investment Impact (2)

- Community Landmarks (1)

- Community News (4)

- Community Planning (1)

- Community Revitalization (1)

- Commuter Neighborhoods (1)

- Cons of Living in Helotes, TX (4)

- Converse Home Sellers (1)

- Converse TX (10)

- Converse TX Real Estate (1)

- Cost of Living Guides (1)

- Cost of Living in San Antonio TX (25)

- CPS Energy Programs (1)

- Deco District San Antonio (1)

- Down Payment Assistance (1)

- Downtown Boerne (1)

- Downtown Development (3)

- Downtown Living (1)

- Downtown Revitalization (14)

- Downtown San Antonio (2)

- Downtown San Antonio Real Estate (5)

- Downtown San Antonio Revitalization (1)

- East Side Neighborhoods (1)

- East Side San Antonio (3)

- Economic Development (2)

- Economic Growth & Industry (1)

- Education, Texas Hill Country (1)

- Employment Corridors (1)

- Entertainment Economy (1)

- Established Communities (2)

- Events in San Antonio (207)

- Expert Advice from Tami Price, Realtor® (9)

- Family Activities (1)

- Family Living in San Antonio (1)

- Far Northwest San Antonio (1)

- Far Westside Real Estate (4)

- Featured Properties (1)

- Financial Planning (1)

- First-Time Buyers (1)

- First-Time Homebuyer Resources (3)

- First-Time Homebuyer Tips (2)

- First-Time Homebuyers (5)

- First-Time Investors (1)

- Fort Sam Houston (2)

- Fort Sam Houston Real Estate (1)

- Fort Sam Houston, TX (2)

- FSBO vs Agent Representation (1)

- Gated Communities (1)

- Green Home Upgrades (1)

- Healthcare (1)

- Helotes Home Sellers (1)

- Highway 151 Corridor Growth (1)

- Hill Country Business (1)

- Hill Country Communities (1)

- Hill Country Development (2)

- Hill Country Living (3)

- Hill Country Market Updates (1)

- Hill Country Real Estate (2)

- Historic Districts (1)

- Historic Neighborhoods (1)

- Historic Preservation (2)

- Holiday Attractions (1)

- Holiday Guide (1)

- Home Buying (7)

- Home Buying Guide (6)

- Home Buying Process (3)

- Home Buying Strategy (1)

- Home Buying Tips (3)

- Home Energy Efficiency San Antonio (1)

- Home Financing (2)

- Home Improvement ROI (1)

- Home Preparation (1)

- Home Pricing Strategy (1)

- Home Renovation for Resale (1)

- Home Selling (2)

- Home Selling Guide (5)

- Home Selling Strategies (2)

- Home Selling Strategy (1)

- Home Selling Tips (8)

- Home Staging and Updates (2)

- Homebuyer Education (3)

- Homebuyer Resources (1)

- Homebuying Tips (3)

- Homeowner (35)

- Homeowner Tax Benefits (1)

- Homeownership Costs (1)

- Homes for Sale (1)

- Homes for sale near Lackland AFB (4)

- Homes Near Military Bases (1)

- Housing (1)

- Housing Community Development (1)

- Housing Development (2)

- Housing Market Updates (3)

- How to Buy a House in San Antonio TX (48)

- Huebner Oaks shopping center (1)

- I-10 Corridor (1)

- Incorporated Cities (5)

- Industrial Investment Impact (1)

- Industry News (2)

- Infrastructure & Growth Projects (26)

- Infrastructure and Sustainability (1)

- Infrastructure Development (1)

- Infrastructure Investment (1)

- Infrastructure Updates (2)

- Invest in San Antonio (46)

- Investment Opportunities (2)

- Investment Property San Antonio (1)

- JBSA (4)

- JBSA Real Estate (4)

- Joint Base San Antonio (5)

- Joint Base San Antonio Housing (1)

- La Cantera Retail Development (1)

- Lackland AFB (6)

- Lackland AFB Housing (1)

- Lera MLS (1)

- Lifestyle & Community Growth (17)

- Lifestyle & Local Growth (12)

- Lifestyle Amenities (1)

- Lifestyle Communities (1)

- Listing Preparation (1)

- Live Oak (1)

- Living in San Antonio, TX (52)

- Living Near Randolph AFB (5)

- Local Attractions (2)

- Local Business & Development (9)

- Local Business & Economy (3)

- Local Business Spotlight (20)

- Local Business Support (5)

- Local Development (3)

- Local Development News (3)

- Local Market Insights (3)

- Local News (2)

- Local News Around San Antonio (2)

- Local Real Estate News (1)

- Loop 1604 Corridor Growth (2)

- Loop 410 Corridor Development (1)

- Luxury Communities (1)

- Luxury Retail San Antonio (1)

- Major Developments (2)

- Making Offers on Homes (1)

- Market Analysis (1)

- Market Conditions (7)

- Market Timing (1)

- Market Trends (7)

- Market Update (5)

- Market Updates (9)

- Master Planned Communities (7)

- Medical Center Area Real Estate (1)

- Military & Economic Impact (3)

- Military Family Resources (1)

- Military Homebuying (1)

- Military Housing (2)

- Military Housing Market in Texas (16)

- Military Life in San Antonio (2)

- Military PCS Relocations (2)

- Military Real Estate (1)

- Military Relocation (4)

- Military Relocation & VA Loans (9)

- Military Relocation San Antonio (3)

- Military Relocation Services (3)

- Military Relocation to San Antonio (49)

- Military Relocations (17)

- Military Relocations & VA Home Loans (5)

- Mixed-Income Housing (1)

- MLS Accuracy & Data Transparency (1)

- Mortgage Programs (1)

- Mothers Day in San Antonio (1)

- Move to Boerne TX (18)

- Move to Castroville TX (11)

- Move to Converse TX (16)

- Move to New Braunfels (1)

- Move to North San Antonio (18)

- Move to San Antonio TX (73)

- Move to Selma TX (19)

- Move to Shertz TX (13)

- Move to Texas (53)

- Move-In Ready Homes (1)

- Move-In Ready Homes San Antonio (2)

- Move-Up Buyers (1)

- Moving to Helotes, TX (17)

- Moving to San Antonio (69)

- Neighborhood Amenities (1)

- Neighborhood Guides (7)

- Neighborhood Investment (1)

- Neighborhood News (2)

- Neighborhood Revitalization (2)

- Neighborhood Spotlights (7)

- Neighborhood Updates (1)

- Neighborhoods near Randolph AFB (12)

- New Braunfels (5)

- New Braunfels News (2)

- New Braunfels Real Estate (1)

- New Businesses (2)

- New Construction (21)

- New Construction Homes (5)

- New Construction Homes San Antonio (1)

- New Construction Without Customization (1)

- New Construction Without the Wait (1)

- New Development (3)

- New Listing (8)

- New Restaurants (3)

- News (211)

- News & updates (213)

- North Central San Antonio (5)

- North San Antonio (6)

- North San Antonio Real Estate (3)

- North Side Neighborhoods (1)

- North Side San Antonio Development (2)

- Northeast Inner Loop (1)

- Northeast Inner Loop Neighborhoods (1)

- Northeast San Antonio (2)

- Northwest San Antonio (6)

- Northwest San Antonio Development (1)

- Northwest San Antonio Growth (1)

- Northwest San Antonio Real Estate (1)

- Northwood (1)

- Olympia Hills (1)

- Parks and Recreation (2)

- PCS Guide (2)

- PCS Moves (2)

- PCS Moves to Joint Base San Antonio (2)

- PCS Planning (1)

- PCS Randolph AFB (17)

- PCS Relocation (1)

- PCS San Antonio (46)

- PCS to San Antonio (42)

- Pearl District Area Real Estate (1)

- Places to Eat Near Randolph AFB (1)

- Pre-Listing Preparation (2)

- Pre-Listing Process (1)

- Pricing and Marketing Strategy (1)

- Professional Awards and Achievements (1)

- Professional Real Estate Representation (1)

- Property Tax Exemptions Texas (1)

- Property Value Enhancement (1)

- pros and cons living in Converse TX (3)

- Pros and Cons Living in Selma TX (6)

- Pros and Cons of Living in Castroville, TX (4)

- Pros and Cons of Living in San Antonio (33)

- Purchase Negotiation (1)

- Quick Close Real Estate (1)

- Randolph AFB Neighborhoods (1)

- Real Estate (1)

- Real Estate Agent Recognition (1)

- Real Estate Agent Selection (2)

- Real Estate Agent Value (1)

- Real Estate Consultation (1)

- Real Estate Finance (1)

- Real Estate Financing (1)

- Real Estate Impact (1)

- Real Estate Investment San Antonio (2)

- Real Estate Legal Issues (1)

- Real Estate Market Insights (2)

- Real Estate Market Trends (3)

- Real Estate Professional Designations (1)

- Real Estate Technology & Trends (2)

- Real Estate Tips and Guides (2)

- Real Estate Trends (4)

- RealTrends Verified (1)

- Regional Real Estate (2)

- Relocating to San Antonio (2)

- Relocation Resources (1)

- Relocation to San Antonio (55)

- Rental Housing (1)

- Resale Properties (1)

- Retail Development (1)

- Retire in Boerne TX (11)

- Retire in San Antonio (37)

- SABOR (21)

- San Antonio Area Listings (1)

- San Antonio Business Growth (1)

- San Antonio Buyer Resources (2)

- San Antonio Communities (2)

- San Antonio Community Events (1)

- San Antonio Community News (1)

- San Antonio Data Center Development (1)

- San Antonio Development (5)

- San Antonio Development & East Side Real Estate (1)

- San Antonio Dining and Lifestyle (2)

- San Antonio East Side Development (1)

- San Antonio Employment Growth (1)

- San Antonio Food & Community Development (2)

- San Antonio Growth (8)

- San Antonio Home Buying and Selling (2)

- San Antonio Home Buying Guide (4)

- San Antonio Home Improvement (2)

- San Antonio Home Sellers (2)

- San Antonio Homeowner Guide (1)

- San Antonio Homeowner Resources (1)

- San Antonio Housing Market & Mortgage Financing (2)

- San Antonio Housing Market Analysis (1)

- San Antonio Housing Trends & Market Analysis (3)

- San Antonio Industrial Development (1)

- San Antonio Industrial Policy (1)

- San Antonio Investment Properties (2)

- San Antonio Job Market (1)

- San Antonio Lifestyle Amenities (1)

- San Antonio Listing (1)

- San Antonio Market (1)

- San Antonio Market Updates (4)

- San Antonio Military Relocation (2)

- San Antonio Neighborhoods (43)

- San Antonio New Construction & Master-Planned Communities (4)

- San Antonio New Home Communities (1)

- San Antonio News (224)

- San Antonio North Side Development (1)

- San Antonio Parks (1)

- San Antonio Property Investment (1)

- San Antonio Property Taxes (1)

- San Antonio Real Estate (37)

- San Antonio Real Estate Agents (2)

- San Antonio Real Estate Excellence (1)

- San Antonio Real Estate Guide (3)

- San Antonio Real Estate Market (30)

- San Antonio Real Estate Market Analysis (6)

- San Antonio Real Estate News (2)

- San Antonio Restaurant News (2)

- San Antonio Restaurant Openings (1)

- San Antonio Seller Resources (1)

- San Antonio Spec Homes (1)

- San Antonio Spurs Community Programs (1)

- San Antonio Suburbs (1)

- San Antonio Transportation (2)

- San Antonio University Area Housing (1)

- San Antonio Urban Living (7)

- San Antonio West Side Development (2)

- San Antonio Zoning Policy (1)

- Schertz Home Sellers (1)

- Schertz, TX (12)

- School Districts (1)

- Sell Home In San Antonio TX (62)

- Seller (83)

- Seller Education (7)

- Seller Guide (2)

- Seller Representation Expertise (1)

- Seller Resources (5)

- Seller Strategy (2)

- Seller Tips (1)

- Sellers (1)

- Selling A Home in San Antonio (60)

- Selling Your San Antonio Home (3)

- Selma TX (9)

- Single-Story Homes (1)

- South San Antonio Real Estate (1)

- South Side Economic Growth (1)

- South Side San Antonio (1)

- Southtown (1)

- Southwest San Antonio Real Estate (1)

- Spec Homes and Inventory Homes (1)

- Spurs Arena Project Marvel (1)

- Stone Oak Community News (4)

- Suburban Housing Growth (12)

- Suburban Living (1)

- Technology Growth (3)

- Technology Sector Growth (1)

- Terrell Hills (3)

- Texas Homestead Exemption (1)

- The Dominion Real Estate (1)

- The Rim Area Real Estate (1)

- Things to do in San Antonio TX (21)

- Things to do Near Randolph AFB (4)

- Time-Sensitive Home Buying (1)

- Tips for Buying New Construction (8)

- Tobin Hill Neighborhoods (1)

- Top Real Estate Agent in San Antonio (3)

- Tourism and Economic Development (1)

- Traders's Joe San Antonio (1)

- Transportation Infrastructure (1)

- Universal City (1)

- Urban Corridor Real Estate (1)

- Urban Development (4)

- Urban Living (2)

- Urban Neighborhoods (1)

- Urban Real Estate (1)

- Urban Renewal Projects (1)

- Urban Revitalization San Antonio (1)

- Utility Cost Reduction (1)

- UTSA Campus Development (1)

- VA Home Loan Benefits (2)

- VA Loan Assumptions (3)

- VA loan benefits (26)

- VA Loan Guidance (1)

- VA Loans (10)

- VA Loans and Military Benefits (2)

- VA Loans and Military Home Buying (2)

- VA Loans San Antonio (43)

- VET Benefits Living in San Antonio (3)

- Veterans Resources (1)

- Village Northwest (1)

- Walkable Communities (1)

- week in sales (21)

- Weekly Sales Report (22)

- West San Antonio (2)

- West San Antonio Development (1)

- West San Antonio Real Estate (3)

- West San Antonio Real Estate Market (2)

- West Side Infrastructure Planning (1)

- West Side Real Estate (1)

- West Side San Antonio (2)

Recent Posts