San Antonio Market Update: What the Latest Sales Data Means for Buyers and Sellers

San Antonio Market Update: What the Latest Sales Data Means for Buyers and Sellers

Meta Title: San Antonio Real Estate Market Update December 2025 | Tami Price REALTOR®

Meta Description: San Antonio real estate market data for late November and early December shows steady sales and rising prices. Learn what this means for buyers and sellers.

Target Keywords: San Antonio real estate market, buying a home in San Antonio, selling a home in San Antonio, homes for sale in San Antonio, best real estate agent in San Antonio, San Antonio housing market

Category Suggestions: Market Update, San Antonio Real Estate, Buyer Resources, Seller Resources

URL Slug: san-antonio-real-estate-market-update-december-2025-sales-data

Meta Keywords: San Antonio real estate market, San Antonio home prices, buying a home in San Antonio, selling a home in San Antonio, San Antonio REALTOR, San Antonio housing data

Introduction: Understanding What Current Market Data Reveals

As the year moves toward its close, the San Antonio real estate market continues demonstrating steady activity that defies typical seasonal slowdowns. Weekly sales data provides valuable insight into buyer behavior, pricing trends, and opportunities for both buyers and sellers navigating current conditions. Understanding these numbers helps households make informed decisions whether they are preparing to purchase their first home, sell a current property, or relocate to the San Antonio area.

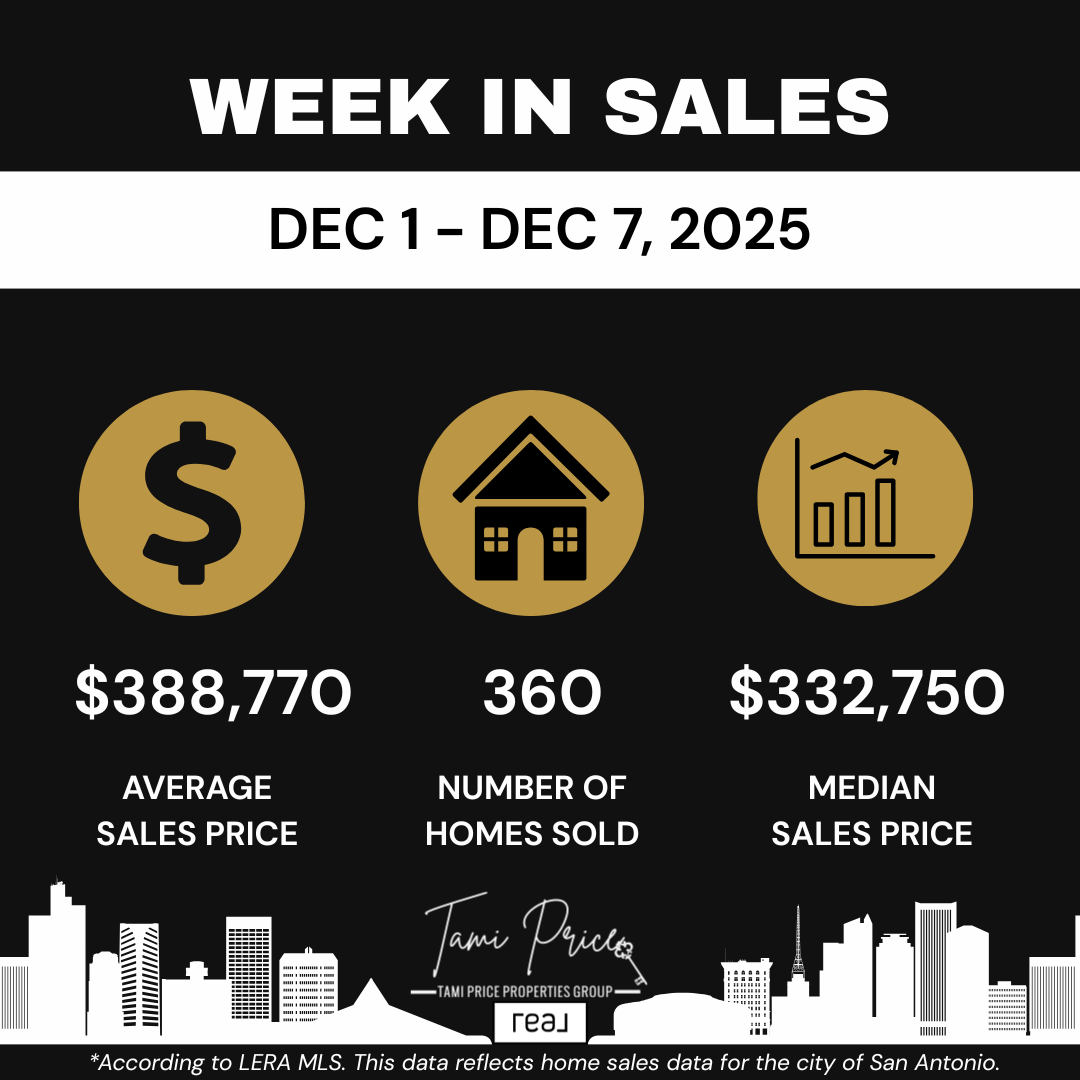

The most recent weekly data covering late November through early December reveals patterns worth examining closely. The week of December 1 through December 7 recorded 360 closed sales with an average sales price of $388,770 and a median sales price of $332,750. The prior week, November 24 through November 30, closed with 344 sales, an average sales price of $377,897, and a median sales price of $319,995. Comparing these consecutive periods illuminates momentum and trajectory that inform strategic decisions.

For those considering buying a home in San Antonio or selling a home in San Antonio, interpreting market data correctly matters significantly. Numbers alone do not tell complete stories. Context about seasonal patterns, price segment dynamics, and local factors all contribute to understanding what data actually means for individual transactions. This guide examines recent sales figures, explains what they suggest for different market participants, and provides guidance for approaching real estate decisions with clarity.

The San Antonio metropolitan area encompasses diverse neighborhoods and communities, each with distinct characteristics and market dynamics. City wide data provides useful benchmarks while recognizing that conditions vary considerably across different areas including Schertz, Cibolo, Helotes, Converse, and Boerne. Working with experienced representation helps translate broad market trends into neighborhood specific guidance relevant to individual circumstances.

What Did the December Sales Data Reveal About Market Activity?

The week of December 1 through December 7 produced results that demonstrate continued buyer engagement despite the approaching holiday season. Recording 360 closed sales during a single week reflects meaningful transaction volume that suggests motivated participants on both sides of the market remain active. This level of activity during early December indicates that seasonal slowdowns, while real, may be less pronounced than in some previous years.

The average sales price of $388,770 represents a notable increase from the prior week's $377,897 figure. This week over week rise of nearly $11,000 in average pricing suggests that higher priced homes closed in greater proportion during the December period. Average prices can shift based on the specific mix of properties closing in any given week, making them useful indicators of market composition rather than direct value comparisons.

Q: What does the median sales price tell us about the market?

A: The median sales price of $332,750 during the December week rose from $319,995 the prior week, representing an increase of approximately $12,750. Median prices indicate the midpoint where half of sales occurred above and half below, providing insight into typical transaction levels. The rise in median pricing suggests healthy demand in the middle market segments where most buyers actively compete.

These figures reflect closed transactions, meaning deals that progressed through contract, inspections, appraisals, and financing to successful completion. The journey from accepted offer to closing typically takes 30 to 45 days, meaning December closings largely originated from contracts written in October and November. This timing context helps interpret what current closing data reveals about buyer behavior during the fall season.

Key observations from December 1 through December 7 data:

- 360 closed sales demonstrating sustained weekly transaction volume

- Average sales price of $388,770 showing increase from prior week

- Median sales price of $332,750 rising approximately $12,750 week over week

- Activity levels remaining strong despite early December timing

- Mix of closings suggesting engagement across multiple price segments

How Did Late November Performance Compare to Early December?

The week of November 24 through November 30 encompassed the Thanksgiving holiday, a period when real estate activity traditionally slows as families gather and attention shifts away from home searches and transactions. Despite this seasonal factor, the market recorded 344 closed sales, demonstrating that motivated buyers and sellers continued progressing toward their goals even during a major holiday week.

The average sales price of $377,897 during the November week established the baseline that December figures exceeded. The median sales price of $319,995 similarly provided the reference point against which the December median increase becomes meaningful. Viewing these consecutive weeks together reveals upward movement in both pricing metrics and transaction volume.

Q: Is week over week comparison meaningful for understanding market trends?

A: Short term comparisons between individual weeks provide useful snapshots but should not be overinterpreted as definitive trend indicators. Weekly data fluctuates based on which specific transactions happen to close during particular periods. However, comparing consecutive weeks helps identify momentum and provides more current information than monthly or quarterly reports that lag behind actual market conditions.

The combined two week period recorded more than 700 closed sales, representing substantial transaction activity during a season when markets often quiet significantly. This volume suggests that San Antonio continues attracting buyers who remain motivated to complete purchases regardless of calendar timing. For sellers, this sustained activity indicates that properly positioned listings can find receptive audiences even during traditionally slower periods.

Late November data highlights:

- 344 closed sales during Thanksgiving week demonstrating resilient activity

- Average sales price of $377,897 establishing baseline for December comparison

- Median sales price of $319,995 reflecting typical transaction levels

- Holiday timing not preventing motivated buyers from closing transactions

- Combined two week total exceeding 700 sales showing sustained market engagement

What Do Rising Prices Suggest for San Antonio Home Sellers?

Sellers in San Antonio can draw encouragement from the week over week price increases reflected in recent data. Both average and median prices rose from the November period to the December period, suggesting that buyers remain willing to pay competitive prices for homes meeting their expectations. This pricing environment rewards sellers who prepare properties appropriately and position them strategically within current market conditions.

The increase in median pricing carries particular significance for sellers in the middle market segments where most transactions occur. Homes priced near the median represent the sweet spot where buyer demand concentrates and competition for desirable properties remains healthy. Sellers with homes in these price ranges can expect continued interest from qualified buyers seeking to complete purchases before year end or position themselves for early new year moves.

Q: How should sellers interpret rising prices when preparing to list?

A: Rising prices do not guarantee that any individual property will command premium pricing. Market data reflects aggregate results across hundreds of transactions with varying characteristics. Sellers should use current data to understand general conditions while relying on localized comparable analysis specific to their property, neighborhood, and price segment. Proper pricing strategy based on actual comparable sales matters more than broad market trends for achieving optimal results.

Strategic timing remains important even in favorable market conditions. The data shows that buyers continue actively closing transactions through the holiday season, challenging assumptions that listing during this period means reduced exposure or activity. Sellers who delayed listing due to seasonal concerns may find current conditions more receptive than anticipated. However, timing decisions should account for individual circumstances alongside market observations.

Seller considerations based on current market data:

- Week over week price increases suggesting healthy buyer demand

- Median price growth indicating strength in middle market segments

- Sustained transaction volume demonstrating active buyer participation

- Holiday season activity exceeding traditional slowdown expectations

- Proper pricing and preparation remaining essential regardless of favorable conditions

- Individual comparable analysis more relevant than aggregate market statistics

How Should Buyers Approach the Current San Antonio Market?

Buyers navigating the San Antonio market can use current data to calibrate expectations and prepare competitive strategies. With more than 700 sales recorded across the two week period examined, the data confirms that buyers have choices and opportunities across various price points. However, the rising prices and sustained activity also indicate that well prepared, decisive buyers hold advantages over those who hesitate or arrive unprepared.

The climb in median pricing from approximately $320,000 to nearly $333,000 within a single week illustrates how quickly market conditions can shift. Buyers targeting specific price ranges may find themselves needing to adjust expectations or expand search parameters as pricing moves. Understanding that conditions evolve continuously helps buyers maintain flexibility and respond appropriately to changing circumstances.

Q: What does strong market activity mean for buyer competition?

A: Sustained sales volume indicates multiple buyers successfully completing purchases weekly. While this demonstrates opportunity, it also suggests competition for desirable properties, particularly updated homes, well maintained properties in sought after locations, and listings priced attractively within their segments. Buyers encountering multiple offer situations or quick sales should recognize these as symptoms of healthy demand rather than unusual circumstances.

Preparation becomes increasingly important as markets remain active. Buyers who enter searches with pre approval in place, clear understanding of their requirements and priorities, and readiness to make timely decisions position themselves advantageously. Those arriving unprepared or moving slowly may watch preferred properties sell to other buyers who demonstrated readiness to proceed.

Buyer strategies for current market conditions:

- Obtain pre approval before beginning active home searches

- Set realistic price expectations based on current median and average figures

- Maintain flexibility as pricing continues evolving

- Prepare to act decisively when appropriate properties become available

- Understand that competition exists for desirable homes across price segments

- Work with experienced representation to navigate offers and negotiations effectively

What Does Seasonal Market Activity Tell Us About San Antonio?

Traditional real estate wisdom suggests that markets slow significantly during the holiday season as attention shifts toward family gatherings, travel, and year end activities. The San Antonio data challenges this assumption, showing robust activity through late November and early December that exceeds typical seasonal slowdown expectations. This pattern reveals characteristics about the San Antonio market worth understanding.

Several factors may contribute to San Antonio's resilience against seasonal slowdowns. The region's military presence through Joint Base San Antonio creates year round relocation demand as service members receive orders requiring moves regardless of calendar timing. Corporate relocations and job transfers similarly operate on employer schedules rather than real estate seasonality. These demand sources help sustain activity when discretionary buyers might otherwise pause.

Q: Should buyers and sellers adjust strategies based on seasonal factors?

A: Seasonal considerations remain relevant even if their effects prove less dramatic than sometimes assumed. Inventory levels typically decline during winter months as fewer sellers choose to list, potentially reducing buyer choices while creating less competition for properties that do come to market. Buyers may find motivated sellers more willing to negotiate during periods with fewer competing offers. Sellers listing during quieter periods may face less competition from similar properties.

The data suggests that waiting for supposedly better market conditions may not provide advantages buyers or sellers anticipate. Activity continues, transactions close, and prices rise even during traditionally slower periods. Those with genuine needs or motivations can proceed confidently knowing the market continues functioning regardless of season.

Seasonal market observations for San Antonio:

- Activity levels exceeding traditional holiday slowdown expectations

- Military relocation demand sustaining year round transaction volume

- Corporate transfers operating independently of real estate seasonality

- Reduced inventory during winter potentially benefiting both buyers and sellers

- Waiting for better conditions possibly providing less advantage than assumed

- Motivated participants finding success regardless of calendar timing

How Do Military Relocations Factor Into San Antonio Market Dynamics?

San Antonio's significant military presence through Joint Base San Antonio creates unique market dynamics that affect both overall activity levels and specific neighborhood conditions. Service members receiving PCS orders must relocate according to military timelines rather than choosing optimal market conditions. This demand source provides consistent transaction volume throughout the year, including during periods when civilian buyers might reduce activity.

Military buyers often face compressed timelines that require efficiency and preparation. House hunting trips may last only days, leaving little time for extended searches or deliberation. Pre approval, clear requirements, and experienced guidance become essential for military families seeking to identify and secure appropriate housing within available windows. The stakes of unsuccessful searches include temporary housing expenses, family separation, and disruption to settling into new assignments.

Q: What should military families understand about the current market?

A: The pricing data showing median sales around $332,750 provides useful benchmarking for military families evaluating what their budgets can accommodate. VA loan eligibility provides advantages including zero down payment requirements and competitive interest rates that help military buyers compete effectively. Understanding current pricing helps families set realistic expectations before beginning searches and avoid frustration from misaligned assumptions.

Working with a REALTOR® holding Military Relocation Professional (MRP) certification provides advantages for military families navigating San Antonio purchases. MRP designated agents understand military specific challenges including timeline pressures, BAH considerations, VA loan requirements, and the unique circumstances military families face. This specialized knowledge helps streamline processes and avoid complications that agents unfamiliar with military relocations might not anticipate.

Military buyer considerations in current market:

- PCS timelines requiring efficient, prepared home searches

- VA loan benefits helping military buyers compete effectively

- Current median pricing providing budget benchmarking guidance

- Compressed house hunting trips demanding advance preparation

- MRP certified agents understanding military specific challenges

- Year round military relocation demand contributing to market activity

What Strategies Help Sellers Succeed in Current Conditions?

Sellers preparing to list homes in San Antonio benefit from understanding how current market data informs strategic decisions. The rising prices and sustained activity create favorable conditions, but individual results depend on proper execution of pricing, presentation, and marketing strategies. Sellers who approach listings strategically typically achieve better outcomes than those relying solely on favorable market conditions to compensate for preparation shortcomings.

Pricing accuracy remains the single most important factor determining listing success. The week over week price movements in recent data demonstrate that market conditions evolve continuously. Prices set based on outdated comparables or aspirational thinking may miss current market positioning. Professional pricing analysis using recent comparable sales from specific neighborhoods provides the foundation for pricing decisions that generate appropriate buyer interest and competitive offers.

Q: How does presentation affect seller success in active markets?

A: Even in markets with strong demand, buyers compare available options and gravitate toward properties presenting best value within their price ranges. Homes showing well through professional photography, appropriate staging, and attention to condition details typically outperform comparable properties with inferior presentation. The competition is not just about price but about how buyers perceive value relative to alternatives they are considering.

Marketing strategies that maximize exposure help ensure properties reach all potential buyers. Comprehensive MLS® listings, professional photography, syndication to major real estate websites, social media promotion, and agent network outreach all contribute to visibility that generates showings and offers. Sellers who limit marketing or work with agents providing minimal promotion may miss buyers who would have paid competitive prices.

Seller success strategies for current conditions:

- Price accurately based on recent comparable sales analysis

- Present homes professionally through staging and photography

- Address condition issues that create buyer objections

- Maximize marketing exposure across multiple channels

- Work with experienced representation providing comprehensive services

- Respond promptly to showing requests and offer communications

How Can Buyers Position Themselves Competitively?

Buyers seeking success in San Antonio's active market benefit from strategic preparation that positions them competitively when desirable properties become available. The data showing hundreds of weekly transactions indicates many buyers successfully complete purchases, but competition for well priced, well presented homes requires readiness to act decisively. Preparation separates successful buyers from those who watch preferred properties sell to others.

Financial preparation provides the foundation for competitive positioning. Pre approval from reputable lenders demonstrates buyer capability and seriousness to sellers evaluating offers. Understanding budget parameters prevents wasted time viewing homes outside realistic ranges. Having earnest money funds accessible and financing documentation organized enables quick response when opportunities arise. These preparations transform interested lookers into capable purchasers.

Q: What makes offers competitive beyond just price?

A: While price matters significantly, other offer terms affect seller decisions. Flexible closing timelines that accommodate seller needs, reasonable option periods that provide inspection time without excessive delays, appropriate earnest money demonstrating commitment, and clean contracts without unnecessary contingencies all contribute to offer strength. Buyers working with experienced agents understand how to construct competitive offers that appeal to sellers across multiple dimensions.

Market knowledge helps buyers recognize value when they encounter it. Understanding current median and average prices provides context for evaluating specific listings. Knowing how quickly well priced homes sell informs decision timelines. Recognizing what features command premiums versus which characteristics limit appeal helps buyers allocate budgets effectively. This knowledge develops through active searching, market observation, and guidance from experienced representation.

Buyer competitive positioning strategies:

- Complete pre approval before beginning active searches

- Understand budget parameters and stick to realistic ranges

- Prepare earnest money funds for quick accessibility

- Construct offers addressing seller needs beyond just price

- Recognize value through market knowledge and observation

- Work with experienced representation for offer strategy guidance

What Should First Time Buyers Know About Current Conditions?

First time buyers entering the San Antonio market face unique challenges alongside the general competitive dynamics current data reveals. Without previous transaction experience, first time buyers must learn processes while simultaneously competing with experienced purchasers who understand how to navigate efficiently. Additional preparation and guidance help level this playing field.

The current median price of approximately $333,000 provides useful benchmarking for first time buyers evaluating what San Antonio homes cost. Entry level properties may fall below this median, but understanding market midpoints helps calibrate expectations. First time buyers sometimes begin searches with assumptions about pricing that do not reflect current reality, leading to frustration when available options do not match mental images of what their budgets should buy.

Q: What resources help first time buyers prepare for San Antonio home purchases?

A: First time buyer education programs, lender consultations explaining financing options, and conversations with experienced agents all provide valuable preparation. Understanding the home buying process before beginning eliminates surprises that derail transactions. First time buyers should invest time in education before rushing into active searches, ensuring they understand each step and what will be required at various stages.

Down payment and closing cost requirements represent significant considerations for first time buyers. While VA loans offer zero down payment options for eligible buyers, conventional financing typically requires down payments ranging from 3% to 20% depending on programs and qualifications. First time buyer assistance programs may provide additional resources. Understanding total cash requirements helps first time buyers establish realistic timelines for readiness.

First time buyer guidance for current market:

- Use median pricing data to calibrate purchase budget expectations

- Invest in education about the home buying process before searching

- Complete pre approval to understand financing options and requirements

- Calculate total cash needs including down payment and closing costs

- Research first time buyer assistance programs and eligibility

- Work with patient, experienced representation willing to educate throughout

How Do Different Price Segments Perform in Current Conditions?

While aggregate market data provides useful overview, conditions vary across different price segments within the San Antonio market. The gap between average and median sales prices in recent data suggests that transactions span wide ranges, with higher priced sales pulling averages above median levels. Understanding segment specific dynamics helps buyers and sellers position appropriately for their particular price ranges.

The median price of $332,750 indicates that half of recent sales occurred below this level and half above. Buyers targeting entry level or mid range homes face different competitive dynamics than those shopping in luxury segments. The concentration of buyer demand often creates more competition in middle segments where most purchasers qualify and search, while higher price points may see fewer competing buyers but also fewer active listings.

Q: Does the average price exceeding median indicate strength in upper price ranges?

A: When average prices exceed medians significantly, it typically indicates that higher priced transactions occurred in sufficient numbers to pull the average upward. The approximately $56,000 gap between average ($388,770) and median ($332,750) in December data suggests some higher priced closings during that week. However, interpreting what this means for specific segments requires analysis beyond aggregate statistics.

Sellers should understand where their properties fit within price segment distributions. Homes priced near the median face maximum buyer competition but also compete with numerous similar listings. Properties in higher ranges may find fewer competing listings but also smaller buyer pools. Pricing strategy must account for segment specific supply and demand dynamics rather than assuming aggregate trends apply uniformly across all price points.

Price segment considerations:

- Median pricing indicating where half of transactions occur above and below

- Average exceeding median suggesting higher priced closings pulling numbers up

- Middle segments often experiencing strongest buyer competition

- Higher price ranges seeing fewer buyers but potentially less listing competition

- Segment specific analysis more relevant than aggregate statistics

- Pricing strategy accounting for supply and demand at specific price levels

What Market Conditions Should Participants Expect Moving Forward?

While predicting future market conditions with certainty remains impossible, current data provides useful context for thinking about likely near term dynamics. The sustained activity through traditionally slower periods suggests underlying demand that should carry into the new year. However, various factors including interest rates, economic conditions, and inventory levels will influence how markets perform in coming months.

Buyers and sellers should approach 2026 with realistic expectations grounded in current data rather than assumptions about dramatic changes in either direction. Markets rarely shift suddenly from seller favorable to buyer favorable conditions or vice versa. More commonly, gradual evolution occurs as supply, demand, pricing, and external factors adjust incrementally over time. Planning based on current conditions while remaining adaptable to changes represents prudent strategy.

Q: Should buyers or sellers rush decisions based on anticipated market changes?

A: Making major real estate decisions based on predictions about future conditions introduces unnecessary risk. Those with genuine needs or motivations should proceed when individual circumstances support doing so rather than timing decisions based on speculative market forecasts. Waiting for better conditions may mean missing opportunities if anticipated changes do not materialize, while rushing unnecessarily may result in suboptimal decisions made under artificial time pressure.

The professionals best positioned to provide guidance about market conditions and timing are REALTORS® with current, local market knowledge and access to the latest transaction data. Broad media coverage of national real estate trends may not reflect San Antonio specific conditions. Local expertise grounded in actual transaction experience provides more relevant insight than generalized commentary about real estate markets nationwide.

Forward looking market considerations:

- Current data suggesting underlying demand continuing into new year

- Markets typically evolving gradually rather than shifting dramatically

- Individual circumstances more important than market timing speculation

- Waiting for better conditions potentially missing current opportunities

- Local expertise more relevant than national real estate commentary

- Adaptable planning based on current conditions while monitoring changes

Expert Insight from Tami Price

"The recent market data shows a steady and confident pace in San Antonio real estate," says Tami Price, REALTOR® and Broker Associate with Real Broker, LLC. "Rising prices and consistent sales volume indicate that buyers and sellers remain active as the year winds down. With more movement than typically expected for this time of year, both sides can benefit from approaching the market with clarity and realistic expectations."

Price brings nearly two decades of experience and approximately 1,000 closed transactions to her work with buyers and sellers throughout San Antonio, Schertz, Cibolo, Helotes, Converse, and Boerne. As a USAF Veteran holding the Military Relocation Professional (MRP) certification, she understands the urgency and unique circumstances military families face when navigating real estate transactions on PCS timelines.

"Market data should guide decisions, not pressure them," Price emphasizes. "Sellers who prepare their homes properly and price based on localized trends often see stronger engagement and smoother negotiations. Buyers who arrive prepared with pre approval and clear understanding of current conditions position themselves to succeed when the right homes become available."

Her recognition as a RealTrends Verified Top Agent and designations including Pricing Strategy Advisor (PSA) and Seller Representative Specialist (SRS) reflect specialized expertise in helping clients interpret market conditions and develop strategies aligned with their goals.

"I continue helping clients interpret these weekly trends so they can make informed decisions and plan their next steps with confidence," Price notes. "Whether someone is buying their first home, selling after decades of ownership, or relocating for military service, understanding what the data actually means for their specific situation makes the difference between stress and success."

Three Key Takeaways

1. San Antonio Recorded Strong Sales Activity Through Late November and Early December Despite Traditional Holiday Slowdowns

The week of December 1 through December 7 produced 360 closed sales with an average price of $388,770 and median price of $332,750. The prior week during Thanksgiving recorded 344 sales with average pricing of $377,897 and median of $319,995. Combined, more than 700 transactions closed across these two weeks, demonstrating that motivated buyers and sellers remain active regardless of seasonal factors that traditionally slow real estate activity.

2. Week Over Week Price Increases Suggest Healthy Demand and Competitive Conditions for Well Positioned Listings

Both average and median sales prices rose from the November period to December, with median pricing climbing approximately $12,750 in a single week. This upward movement indicates that buyers remain willing to pay competitive prices for homes meeting their expectations. Sellers can take encouragement from these trends while recognizing that individual results depend on proper pricing, presentation, and marketing strategies rather than relying solely on favorable market conditions.

3. Buyers and Sellers Should Approach the Market With Preparation, Realistic Expectations, and Experienced Guidance

Current data reveals an active market where prepared participants succeed while unprepared ones struggle. Buyers benefit from pre approval, clear understanding of current pricing, and readiness to act decisively. Sellers benefit from accurate pricing, professional presentation, and comprehensive marketing. Those considering buying a home in San Antonio or selling a home in San Antonio should work with experienced representation to translate market data into strategies specific to their circumstances.

Frequently Asked Questions

Q: How many homes sold in San Antonio during early December?

A: The week of December 1 through December 7 recorded 360 closed sales in San Antonio. This figure represents transactions that completed all steps from contract through closing during that specific week. Combined with 344 sales the prior week, more than 700 transactions closed across the two week period examined.

Q: What was the median home price in San Antonio during early December?

A: The median sales price during the week of December 1 through December 7 reached $332,750. This represents an increase from $319,995 the prior week, a rise of approximately $12,750. The median indicates the midpoint where half of sales occurred above and half below this figure.

Q: What was the average home price in San Antonio during this period?

A: The average sales price during the week of December 1 through December 7 reached $388,770, up from $377,897 the prior week. The gap between average and median prices indicates that some higher priced transactions occurred during this period, pulling the average above the median level.

Q: Is the market slowing down for the holidays?

A: The data suggests less seasonal slowdown than traditionally expected. With more than 700 sales across two weeks that included Thanksgiving, activity remained robust despite holiday timing. Motivated buyers and sellers continued progressing toward their goals regardless of calendar factors that historically reduce real estate activity.

Q: What do rising prices mean for buyers?

A: Rising prices indicate that buyers remain willing to pay competitive prices for homes meeting their expectations. Buyers should set realistic budget expectations based on current data, arrive prepared with pre approval, and be ready to act decisively when appropriate properties become available. Competition exists for desirable homes, rewarding preparation over hesitation.

Q: What do rising prices mean for sellers?

A: Rising prices create favorable conditions for sellers who prepare properties appropriately and price strategically. However, individual results depend on accurate pricing based on comparable sales, professional presentation, and effective marketing rather than assuming favorable trends guarantee premium prices for any specific listing.

Q: How long does it take to close on a home in San Antonio?

A: Typical closings occur 30 to 45 days after contract acceptance, though timelines vary based on financing type, inspection outcomes, and various transaction factors. The December closing data reflects contracts likely written in October and November that progressed through all required steps to completion.

Q: Should I wait for better market conditions to buy or sell?

A: Making real estate decisions based on predictions about future conditions introduces uncertainty. Those with genuine needs or motivations should proceed when individual circumstances support doing so rather than attempting to time markets. Current conditions show active markets where prepared participants succeed, suggesting waiting may not provide anticipated advantages.

The Bottom Line

The recent market data reveals a San Antonio real estate market maintaining steady momentum as the year concludes. Rising prices and consistent sales volume indicate that buyers and sellers remain actively engaged despite seasonal factors that traditionally slow activity. With more than 700 transactions closing across just two weeks, including the Thanksgiving holiday period, the data demonstrates underlying demand that should carry forward into the new year.

For sellers, current conditions create opportunities for properly prepared and priced listings to attract competitive offers from motivated buyers. The week over week price increases suggest healthy demand across price segments, particularly in the middle market ranges where median pricing applies. Sellers who invest in accurate pricing, professional presentation, and comprehensive marketing position themselves to capitalize on favorable conditions.

For buyers, the data confirms both opportunity and competition. Hundreds of buyers successfully completed purchases during this period, demonstrating that homes are available and transactions are closing. However, well prepared buyers with pre approval, clear requirements, and readiness to act decisively hold advantages over those arriving unprepared or moving slowly. Understanding current pricing through median and average figures helps calibrate expectations and inform budget decisions.

Working with experienced representation helps both buyers and sellers translate aggregate market data into strategies specific to individual circumstances. Broad trends provide useful context, but successful transactions require neighborhood specific analysis, property level evaluation, and guidance from professionals with current, local market knowledge. The numbers tell part of the story, but experience and expertise complete the picture.

Contact Tami Price, REALTOR®

Whether preparing to buy, sell, or simply understand current market conditions, working with an experienced REALTOR® provides the guidance needed to navigate San Antonio real estate successfully. Tami Price brings local market knowledge, professional expertise, and commitment to client success that helps households achieve their real estate goals.

From first time buyers learning the process to experienced homeowners evaluating their next moves, personalized service makes the difference in successful transactions.

Tami Price, REALTOR®, Broker Associate

📞 210-620-6681

Tami Price's Specialties

- Comprehensive Buyer and Seller Representation

- Military Relocations and PCS Moves

- VA Loan Guidance and Assumptions

- New Construction Navigation

- Strategic Pricing and Market Analysis

- Professional Property Marketing

- First Time Buyer Education

- Move Up and Downsizing Transitions

- Residential Real Estate Throughout San Antonio, Schertz, Cibolo, Helotes, Converse, and Boerne

Disclaimer

This blog post is provided for informational purposes only and should not be construed as guarantees regarding property values, market conditions, or transaction outcomes. Market data reflects the specific time periods examined and conditions change continuously. Real estate decisions should be based on individual circumstances, professional guidance, and current market conditions at the time of transaction. Past market performance does not predict future results. Readers should conduct independent research and consult with qualified professionals before making real estate decisions. Tami Price, REALTOR®, and Real Broker, LLC make no warranties regarding accuracy, completeness, or applicability of information to specific circumstances.

Categories

- All Blogs (705)

- Home Buying (8)

- Neighborhood Guides (32)

- About Tami Price (3)

- Affordable Housing & Community Development (3)

- Agent Qualifications and Credentials (1)

- Agent Qualifications and Experience (1)

- AI and Real Estate Tools (1)

- Alamo Heights (5)

- Alamo Heights Real Estate (1)

- Alamo Ranch (1)

- Amenities in Helotes, Texas (3)

- Apartment Market (1)

- Arts and Culture (1)

- Awards and Recognition (2)

- Best Neighborhoods to Live in Cibolo, TX (3)

- Best Neighborhoods to Live in San Antonio (16)

- Best Places to Live in Leon Valley: A Neighborhood Guide (1)

- Best Places to Live in Northeast Inner Loop: A Neighborhood Guide (1)

- Bexar County Property Tax (1)

- Bexar County Real Estate (2)

- Boerne Home Sellers (1)

- Boerne Neighborhoods (2)

- Boerne Texas (7)

- Broadway Corridor Development (1)

- Build-to-Rent Communities (1)

- Builder Contracts & Warranties (2)

- Builder Warranties (1)

- Buyer (97)

- Buyer and Seller Guidance (3)

- Buyer Due Diligence (1)

- Buyer Education (25)

- Buyer Guide (8)

- Buyer Protection Strategies (1)

- Buyer Representation (1)

- Buyer Representation Expertise (1)

- Buyer Resources (10)

- Buyer Strategy (2)

- Buyers (2)

- Buying a Foreclosed Home in San Antonio (10)

- Buying a Home (1)

- Buying a Home in San Antonio (6)

- Castroville, TX (8)

- Central San Antonio (1)

- Central San Antonio Development (2)

- Central Texas Growth (1)

- Choosing a Real Estate Agent (1)

- Cibolo Home Sellers (1)

- Cibolo TX (14)

- Client Satisfaction (1)

- Client Testimonial (4)

- Clients review (4)

- Comal County (1)

- Commercial & Retail Development (27)

- Commercial Development (13)

- Commercial Development Impact on Home Values (1)

- Commercial Real Estate (1)

- Community Amenities (2)

- Community Development (23)

- Community Development and Real Estate (3)

- Community Events & Development (1)

- Community Infrastructure (1)

- Community Investment Impact (2)

- Community Landmarks (1)

- Community News (4)

- Community Planning (2)

- Community Revitalization (1)

- Commuter Neighborhoods (1)

- Cons of Living in Helotes, TX (4)

- Conservation Communities (1)

- Converse Home Sellers (1)

- Converse TX (10)

- Converse TX Real Estate (1)

- Cost of Living Guides (1)

- Cost of Living in San Antonio TX (25)

- CPS Energy Programs (1)

- Deco District San Antonio (1)

- Denver Heights (1)

- Down Payment Assistance (1)

- Downtown Boerne (1)

- Downtown Development (3)

- Downtown Living (1)

- Downtown Revitalization (14)

- Downtown San Antonio (2)

- Downtown San Antonio Real Estate (5)

- Downtown San Antonio Revitalization (1)

- East Side Neighborhoods (1)

- East Side San Antonio (4)

- Economic Development (3)

- Economic Growth & Industry (1)

- Education, Texas Hill Country (1)

- Employment (1)

- Employment Corridors (1)

- Entertainment Economy (1)

- Established Communities (3)

- Events in San Antonio (207)

- Expert Advice from Tami Price, Realtor® (10)

- Family Activities (2)

- Family Living in San Antonio (1)

- Far Northwest San Antonio (1)

- Far Westside Real Estate (4)

- Featured Homes for Sale (3)

- Featured Properties (1)

- Financial Planning (1)

- First Time Buyers (3)

- First-Time Buyers (2)

- First-Time Homebuyer Resources (3)

- First-Time Homebuyer Tips (2)

- First-Time Homebuyers (5)

- First-Time Investors (1)

- Fort Sam Houston (2)

- Fort Sam Houston Real Estate (1)

- Fort Sam Houston, TX (2)

- FSBO vs Agent Representation (1)

- Gated Communities (2)

- Golf Communities (1)

- Greater San Antonio Housing Trends (2)

- Greater San Antonio Real Estate (3)

- Green Home Upgrades (1)

- Growth and Development (2)

- Healthcare (1)

- Helotes Home Sellers (1)

- Highway 151 Corridor Growth (1)

- Hill Country Business (1)

- Hill Country Communities (2)

- Hill Country Development (3)

- Hill Country Living (3)

- Hill Country Market Updates (1)

- Hill Country Real Estate (4)

- Historic Districts (1)

- Historic Neighborhoods (4)

- Historic Preservation (2)

- Holiday Attractions (1)

- Holiday Guide (1)

- Home Buying (7)

- Home Buying Education (2)

- Home Buying Guide (6)

- Home Buying Process (7)

- Home Buying Strategy (2)

- Home Buying Tips (4)

- Home Energy Efficiency San Antonio (1)

- Home Financing (2)

- Home Improvement ROI (1)

- Home Preparation (1)

- Home Pricing Strategy (3)

- Home Renovation for Resale (1)

- Home Selling (5)

- Home Selling Guide (8)

- Home Selling Strategies (2)

- Home Selling Strategy (1)

- Home Selling Tips (10)

- Home Staging and Updates (2)

- Home Values (1)

- Homebuyer Education (11)

- Homebuyer Resources (1)

- Homebuying Tips (3)

- Homeowner (35)

- Homeowner Tax Benefits (1)

- Homeownership Costs (1)

- Homes for Sale (1)

- Homes for sale near Lackland AFB (4)

- Homes Near Military Bases (1)

- Homestead amenities (1)

- Housing (1)

- Housing Community Development (1)

- Housing Development (2)

- Housing Market Updates (3)

- How to Buy a House in San Antonio TX (48)

- Huebner Oaks shopping center (1)

- I-10 Corridor (1)

- I-35 Corridor (1)

- Incorporated Cities (5)

- Industrial Investment Impact (1)

- Industry News (2)

- Infrastructure & Growth Projects (26)

- Infrastructure and Sustainability (1)

- Infrastructure Development (1)

- Infrastructure Investment (1)

- Infrastructure Updates (2)

- Interest Rates (1)

- Invest in San Antonio (46)

- Investment Opportunities (2)

- Investment Property San Antonio (1)

- JBSA (5)

- JBSA Real Estate (4)

- Joint Base San Antonio (5)

- Joint Base San Antonio Housing (1)

- Kendall County (1)

- La Cantera Retail Development (1)

- Lackland AFB (6)

- Lackland AFB Housing (1)

- Land Conservation (1)

- Land Use Planning (1)

- Lera MLS (3)

- Lifestyle & Community Growth (18)

- Lifestyle & Local Growth (12)

- Lifestyle Amenities (1)

- Lifestyle Communities (1)

- Listing Preparation (1)

- Live Oak (1)

- Living in San Antonio, TX (52)

- Living Near Randolph AFB (5)

- Local Attractions (3)

- Local Business (1)

- Local Business & Development (9)

- Local Business & Economy (3)

- Local Business Spotlight (20)

- Local Business Support (5)

- Local Development (4)

- Local Development News (9)

- Local Market Insights (4)

- Local News (2)

- Local News Around San Antonio (2)

- Local Policy Changes (1)

- Local Real Estate News (1)

- Loop 1604 Corridor Growth (2)

- Loop 410 Corridor Development (1)

- Luxury Communities (2)

- Luxury Retail San Antonio (1)

- Major Developments (2)

- Making Offers on Homes (1)

- Market Analysis (4)

- Market Conditions (14)

- Market Insights (2)

- Market Strategy (1)

- Market Timing (1)

- Market Trends (9)

- Market Trends & Insights (2)

- Market Update (7)

- Market Updates (9)

- Master Planned Communities (12)

- Medical Center Area Real Estate (1)

- Military & Economic Impact (3)

- Military Family Resources (1)

- Military Heritage (1)

- Military Homebuying (1)

- Military Housing (3)

- Military Housing Market in Texas (16)

- Military Life in San Antonio (2)

- Military Neighborhoods (1)

- Military PCS Relocations (3)

- Military Real Estate (2)

- Military Relocation (11)

- Military Relocation & VA Loans (9)

- Military Relocation San Antonio (4)

- Military Relocation Services (3)

- Military Relocation to San Antonio (50)

- Military Relocations (17)

- Military Relocations & VA Home Loans (5)

- Mixed-Income Housing (1)

- MLS Accuracy & Data Transparency (1)

- Mortgage Programs (1)

- Mothers Day in San Antonio (1)

- Move to Boerne TX (18)

- Move to Castroville TX (11)

- Move to Converse TX (16)

- Move to New Braunfels (1)

- Move to North San Antonio (19)

- Move to San Antonio TX (73)

- Move to Selma TX (19)

- Move to Shertz TX (13)

- Move to Texas (53)

- Move Up Buyers (1)

- Move-In Ready Homes (1)

- Move-In Ready Homes San Antonio (2)

- Move-Up Buyers (1)

- Moving to Helotes, TX (17)

- Moving to San Antonio (69)

- Neighborhood Amenities (1)

- Neighborhood Guides (7)

- Neighborhood Investment (1)

- Neighborhood News (2)

- Neighborhood Revitalization (2)

- Neighborhood Spotlights (12)

- Neighborhood Updates (1)

- Neighborhoods near Randolph AFB (12)

- New Braunfels (6)

- New Braunfels News (3)

- New Braunfels Real Estate (1)

- New Businesses (2)

- New Construction (28)

- New Construction Communities (1)

- New Construction Homes (11)

- New Construction Homes San Antonio (5)

- New Construction Without Customization (1)

- New Construction Without the Wait (1)

- New Development (3)

- New Listing (11)

- New Restaurants (3)

- News (211)

- News & updates (213)

- North Central San Antonio (5)

- North San Antonio (8)

- North San Antonio Real Estate (3)

- North Side Neighborhoods (1)

- North Side San Antonio Development (2)

- Northeast Inner Loop (1)

- Northeast Inner Loop Neighborhoods (1)

- Northeast San Antonio (3)

- Northwest San Antonio (6)

- Northwest San Antonio Development (1)

- Northwest San Antonio Growth (1)

- Northwest San Antonio Real Estate (3)

- Northwood (1)

- Olympia Hills (1)

- Parks and Recreation (2)

- PCS Guide (2)

- PCS Moves (2)

- PCS Moves to Joint Base San Antonio (2)

- PCS Planning (1)

- PCS Randolph AFB (17)

- PCS Relocation (1)

- PCS San Antonio (46)

- PCS to San Antonio (42)

- Pearl District Area Real Estate (2)

- Places to Eat Near Randolph AFB (1)

- Pre-Listing Preparation (2)

- Pre-Listing Process (1)

- Pricing and Marketing Strategy (1)

- Professional Awards and Achievements (1)

- Professional Real Estate Representation (1)

- Property Tax Exemptions Texas (1)

- Property Value Enhancement (1)

- pros and cons living in Converse TX (3)

- Pros and Cons Living in Selma TX (6)

- Pros and Cons of Living in Castroville, TX (4)

- Pros and Cons of Living in San Antonio (33)

- Purchase Negotiation (1)

- Quality of Life (1)

- Quick Close Real Estate (1)

- Randolph AFB Neighborhoods (1)

- Real Estate (1)

- Real Estate Agent Recognition (1)

- Real Estate Agent Selection (2)

- Real Estate Agent Value (1)

- Real Estate Consultation (1)

- Real Estate Finance (1)

- Real Estate Financing (1)

- Real Estate Impact (1)

- Real Estate Investment San Antonio (2)

- Real Estate Legal Issues (1)

- Real Estate Market Insights (2)

- Real Estate Market Trends (5)

- Real Estate Professional Designations (1)

- Real Estate Technology & Trends (2)

- Real Estate Tips and Guides (2)

- Real Estate Trends (4)

- RealTrends Verified (1)

- Regional Real Estate (2)

- Relocating to San Antonio (2)

- Relocation (3)

- Relocation & Military Homebuying (1)

- Relocation Resources (2)

- Relocation to San Antonio (55)

- Rental Housing (1)

- Resale Properties (1)

- Retail Development (2)

- Retire in Boerne TX (11)

- Retire in San Antonio (37)

- SABOR (21)

- San Antonio Area Listings (1)

- San Antonio Business Growth (1)

- San Antonio Buyer Resources (2)

- San Antonio Communities (2)

- San Antonio Community Events (1)

- San Antonio Community News (1)

- San Antonio Data Center Development (1)

- San Antonio Development (5)

- San Antonio Development & East Side Real Estate (1)

- San Antonio Dining and Lifestyle (3)

- San Antonio East Side Development (1)

- San Antonio Employment Growth (1)

- San Antonio Food & Community Development (2)

- San Antonio Growth (8)

- San Antonio Home Buying and Selling (2)

- San Antonio Home Buying Guide (4)

- San Antonio Home Improvement (2)

- San antonio home prices (1)

- San Antonio Home Sellers (2)

- San Antonio Homeowner Guide (1)

- San Antonio Homeowner Resources (1)

- San Antonio Housing Market & Mortgage Financing (2)

- San Antonio Housing Market Analysis (1)

- San Antonio Housing Trends & Market Analysis (4)

- San Antonio Industrial Development (1)

- San Antonio Industrial Policy (1)

- San Antonio Investment Properties (2)

- San Antonio Job Market (1)

- San Antonio Lifestyle Amenities (1)

- San Antonio Listing (1)

- San Antonio Living (1)

- San Antonio Market (2)

- San Antonio Market Updates (15)

- San Antonio Military Relocation (2)

- San Antonio Neighborhoods (55)

- San Antonio New Construction & Master-Planned Communities (4)

- San Antonio New Home Communities (1)

- San Antonio News (229)

- San Antonio North Side Development (1)

- San Antonio Parks (1)

- San Antonio Property Investment (1)

- San Antonio Property Taxes (1)

- San Antonio Real Estate (55)

- San Antonio Real Estate Agents (2)

- San Antonio Real Estate Excellence (1)

- San Antonio Real Estate Guide (6)

- San Antonio Real Estate Market (37)

- San Antonio Real Estate Market Analysis (6)

- San Antonio Real Estate News (2)

- San Antonio Restaurant News (2)

- San Antonio Restaurant Openings (1)

- San Antonio Seller Resources (1)

- San Antonio Spec Homes (1)

- San Antonio Spurs Community Programs (1)

- San Antonio Suburbs (1)

- San Antonio Transportation (2)

- San Antonio University Area Housing (1)

- San Antonio Urban Living (7)

- San Antonio West Side Development (2)

- San Antonio Zoning Policy (1)

- Schertz Home Sellers (1)

- Schertz, TX (13)

- School Districts (1)

- Sell Home In San Antonio TX (64)

- Seller (83)

- Seller Education (12)

- Seller Guide (4)

- Seller Representation Expertise (1)

- Seller Resources (9)

- Seller Strategy (2)

- Seller Tips (1)

- Sellers (3)

- Selling A Home in San Antonio (61)

- Selling Your San Antonio Home (3)

- Selma TX (9)

- Single-Story Homes (1)

- South San Antonio Real Estate (1)

- South Side Economic Growth (1)

- South Side San Antonio (1)

- Southtown (1)

- Southwest San Antonio Real Estate (1)

- Spec Homes and Inventory Homes (1)

- Spurs Arena Project Marvel (1)

- Stone Oak Community News (5)

- Suburban Housing Growth (12)

- Suburban Living (1)

- Technology Growth (3)

- Technology Sector Growth (1)

- Terrell Hills (3)

- Texas Homestead Exemption (1)

- The Dominion Real Estate (1)

- The Rim Area Real Estate (1)

- Things to do in San Antonio TX (21)

- Things to do Near Randolph AFB (4)

- Time-Sensitive Home Buying (1)

- Tips for Buying New Construction (9)

- Tobin Hill Neighborhoods (2)

- Top Real Estate Agent in San Antonio (3)

- Tourism and Economic Development (1)

- Traders's Joe San Antonio (1)

- Transportation Infrastructure (1)

- Universal City (1)

- Universal City Real Estate (1)

- Urban Corridor Real Estate (1)

- Urban Development (5)

- Urban Living (2)

- Urban Neighborhoods (4)

- Urban Real Estate (1)

- Urban Renewal Projects (1)

- Urban Revitalization San Antonio (1)

- Utility Cost Reduction (1)

- UTSA Campus Development (1)

- VA Home Loan Benefits (3)

- VA Loan Assumptions (3)

- VA loan benefits (27)

- VA Loan Guidance (1)

- VA Loan Home Buying Assistance (2)

- VA Loans (13)

- VA Loans and Military Benefits (2)

- VA Loans and Military Home Buying (3)

- VA Loans San Antonio (43)

- VET Benefits Living in San Antonio (3)

- Veterans Resources (1)

- Village Northwest (1)

- Walkable Communities (1)

- week in sales (25)

- Weekly Sales Report (26)

- West San Antonio (2)

- West San Antonio Development (1)

- West San Antonio Real Estate (3)

- West San Antonio Real Estate Market (2)

- West Side Infrastructure Planning (1)

- West Side Real Estate (1)

- West Side San Antonio (2)

Recent Posts